Telegram Coin Notcoin (NOT) price is showing signs of potential recovery after noting a sizeable drawdown these last few days.

This recovery depends on market conditions and investors, the latter of whom are sending mixed signals.

Telegram Coin’s Investors Make Interesting Moves

Notcoin’s price is bound to benefit from a positive outlook, which the NOT holders are clearly exhibiting at the moment. This is visible in the Telegram coin’s highly positive funding rate, which indicates strong confidence and conviction among traders.

This sentiment reflects a bullish outlook in the market, as investors are willing to pay a premium to maintain their long positions. In other words, the long contracts are dominating the short contracts presently.

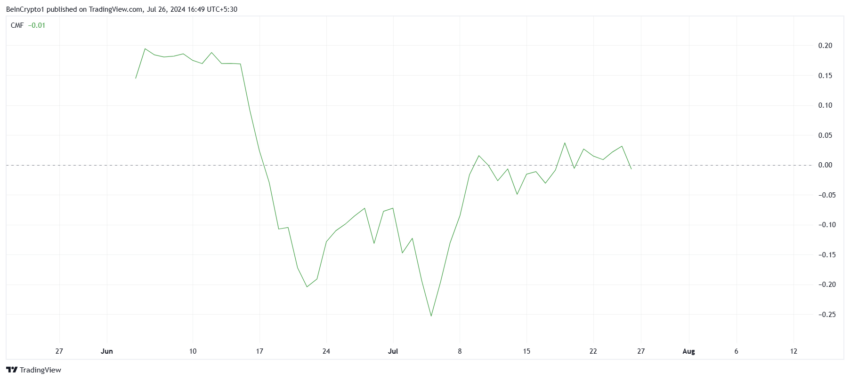

However, the CMF (Chaikin Money Flow) tells a different story. This technical indicator, which measures the flow of money in and out of an asset, shows that the altcoin is struggling to attract significant inflows from investors.

The discrepancy between the funding rate and the CMF suggests a mixed market sentiment. While the high funding rate points to optimism, the lack of substantial inflows indicated by the CMF highlights underlying concerns among investors.

Read More: What is Notcoin (NOT)? A Guide to the Telegram-Based GameFi Token

Ultimately, this situation underscores the complexity of the current market dynamics, which hint neither at a recovery nor a decline.

NOT Price Prediction: What Lies Ahead Lies Sideways

Notcoin’s price is likely looking at consolidation since the investors are pining for a price rise, but the inflows are not strong enough to execute this bullishness. As is, NOT has been oscillating within the $0.017 resistance and $0.015 support level.

At the time of writing, Notcoin’s price was trading at $0.014. It will probably establish $0.013 as the new lower limit. The resistance line mentioned above will continue to remain intact, acting as the upper limit of the consolidation.

Read More: How To Buy Notcoin (NOT) and Everything You Need To Know

A breakdown or a breakout would both invalidate the bullish-neutral thesis. While a breakout will push NOT to $0.020, a breakdown will result in a decline to $0.0095.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment