Investors may be looking to altcoins as the crypto market enters an interesting phase. Over the last few weeks, the prices of these cryptos have shown a glimpse of consistently running upwards.

However, these cryptos have been unable to sustain the momentum. Moreover, the values of most of them dropped in the last 24 hours. But here’s why the decline is not destined to keep investors on the sidelines.

Altcoins Struggle, But Indicators Offer Promise

Two indicators that indicate whether altcoin prices will increase or not include the TOTAL2 and Bitcoin (BTC) dominance charts.

The TOTAL2 is the total market cap of the top 125 cryptocurrencies, excluding BTC. Bitcoin dominance is, however, also significant to the crypto market, as it reflects the coin’s relative market share in comparison to altcoins.

Typically, a rise in Bitcoin dominance and a fall in TOTAL2 means BTC is performing better than the average altcoin and may continue to do so. However, if it is the other way around, altcoins are in control.

During this cycle, altcoins have made various attempts to keep Bitcoin behind them. But the number one cryptocurrency keeps nullifying that position.

Read More: Which Are the Best Altcoins To Invest in July 2024?

As shown above, Bitcoin’s dominance fell from 55.80% to 55.41%. However, the market cap of altcoins followed in the same direction. Unlike BTC, TOTAL2 notes a 3.86% increase that has taken it back above $1.05 trillion.

If the value continues to increase, non-Bitcoin crypto prices could experience respite. If Bitcoin dominance falls in the process, BTC may drop toward $65,000. But if that does not happen, the prices of the coins might stall in similar regions.

Apart from the increase, the Exponential Moving Average (EMA) also shows signs that altcoin may see a notable jump.

At press time, the 20 EMA (blue) is on the cusp of rising above the 50 EMA (yellow). Should this happen, it will be a bullish crossover, which may confirm an upswing.

More Inflows Means Altcoin Dominance No Pipe Dream

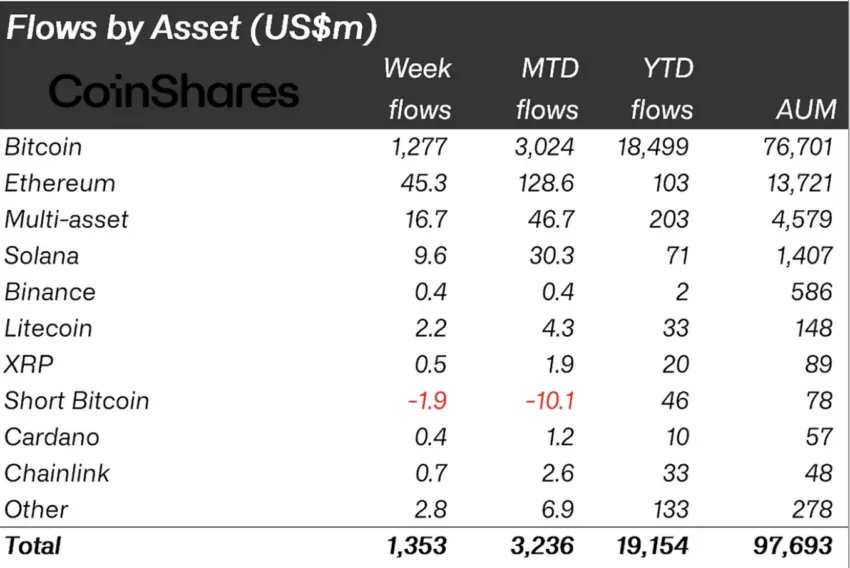

Furthermore, crypto investment inflows into altcoins were distributed across all the cryptos involved last week. This is one unprecedented happening that has not occurred for some time.

According to CoinShares, cryptocurrencies including Ethereum (ETH), Solana (SOL), and Binance Coin (BNB) registered positive netflows.

A situation like this points to increased confidence in their near-term potential. If sustained, the market may move closer to the much-anticipated altcoin season.

Read More: 10 Best Altcoin Exchanges In 2024

However, not every analyst is bullish on altcoin at the moment. While there are some optimists like Michaël van de Poppe, Benjamin Cowen seems to be treading with caution.

According to Cowen, the founder of IntoTheCryptoverse, it could take two more months for the cryptocurrencies to start outperforming BTC.

“Bitcoin dominance monthly candle reminds me of May 2019, which was 2 months before the Fed cut rates last cycle.BTC also had an explosive move back then, and ALTs could not keep up. Similar candle today, potentially 2 months before the 1st rate cut.” Cowen shared on X.

By the look of things, altcoins have the potential to recover from their recent downturn. However, if Bitcoin’s price nears $70,000, as predicted earlier, the bullish outlook for these cryptos may be invalidated.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment