This past weekend was a relatively volatile one for Bitcoin’s (BTC) price. On July 21, the coin reached $68,6410 following a series of macroeconomic developments.

While BTC has been pegged back to $67,218, this on-chain analysis explains why the price could be set to retest a prestigious threshold it has evaded for almost two months.

Bitcoin Is Not Ready to Hold Back

Bitcoin’s performance over the last seven days has been much better than that of the last month. During that period, the price of BTC increased by 6.89%.

However, the coin paints a more bullish picture as July approaches its last ten days. BeInCrypto noticed this after analyzing the In/Out of Money Around Price (IOMAP) indicator.

The IOMAP classifies addresses into those making money at the current price. Put simply, this refers to those who bought BTC at a lower price than the press time value. It also looks at those who purchased at a higher value (out of the money) and those who accumulated at the current price.

If there is a larger number of addresses in the money, Bitcoin gets support, and the price may trade higher. However, if it is the other way around, it is resistance, and BTC may experience a price drop.

Read More: Bitcoin Halving History: Everything You Need To Know

According to IntoTheBlock above, 1.58 million addresses purchased BTC between $65,323 and $67,353. This number is much more than the addresses that accumulated at every point between $69,425 and $72,500.

Therefore, Bitcoin’s support lies around $66,388. If sustained, it may break past the overhead resistance up to $69,455.

Outside of the on-chain domain, the upcoming Bitcoin conference, slated for July 25 to 27, is one factor that could drive Bitcoin’s price higher.

This is because U.S. presidential candidate and frontrunner Donald Trump is expected to speak at the event. Also, the broader crypto market seems to have become a crucial factor in the outcome of the November elections.

Biden’s Announcement Moves the Needle for Bitcoin

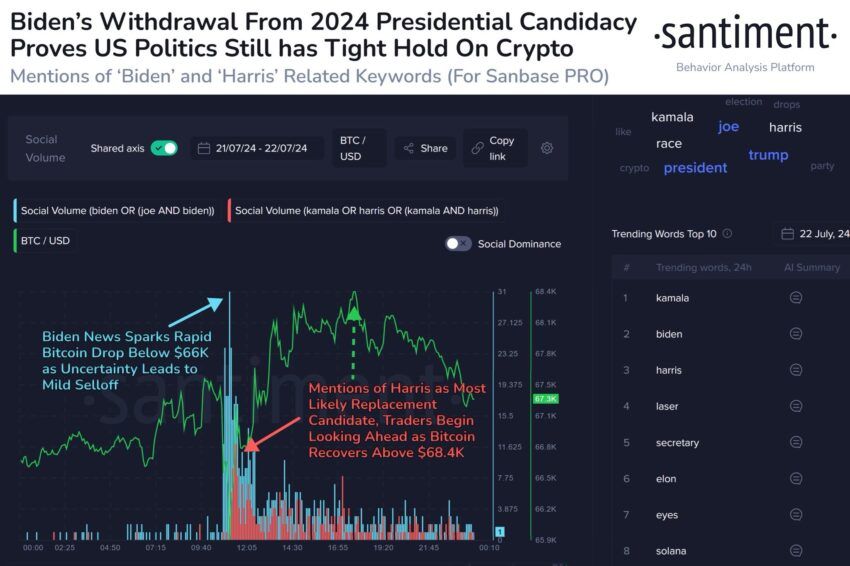

Apart from that, the elections took an interesting turn yesterday, July 21, as current President Joe Biden stepped down his bid. Minutes after the disclosure, Bitcoin’s price flash crashed below $67,000.

But, according to santiment, Biden’s nomination of Vice President Kamala Harris triggered a rebound as the coin retested $68,400. This is similar to the coin’s reaction after Trump’s assassination attempt.

On several occasions, Trump has told the crypto community that he will ease Biden’s “war” on the industry. As a result, several bigwigs in the crypto sector have decided to back him.

Therefore, the former president may reinforce the intentions again. If this happens, Bitcoin’s chances of accelerating toward $70,000 may be higher.

BTC Price Prediction: A New Monthly High Looks Closer

Despite a slight pullback, BTC trades above key support levels, indicating that the chances of an upswing remain present. However, some indicators on the daily chart provide mixed signals.

One indicator examined is the Money Flow Index (MFI). The MFI measures buying and selling pressure by employing price and volume. It also indicates whether an asset is overbought or oversold.

Readings above 80 indicate an overbought level, and those below 20 indicate an oversold region. At press time, the MFI is 79.52, indicating that Bitcoin could soon be overbought.

If this happens, it could be challenging to hit $68,030. However, the Awesome Oscillator (AO), which measures momentum, is positive. Positive readings indicate an increasing upward momentum, while negative ones suggest otherwise.

Read More: Bitcoin (BTC) Price Prediction 2024/2025/2030

Thus, the AO reading at press time indicates that Bitcoin could move closer to or above $70,000. If this remains the situation, the coin may cross above $68,030, and the next target could be around $71,982.

However, Bitcoin risks a decline, especially as the defunct exchange Mt.Gox seems prepared to repay its creditors, according to Spot On Chain.

Once this begins, it may be challenging for BTC to rise above $70,000. Should this happen, BTC’s next move could be a decrease to $64,928.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment