Solana’s (SOL) price is following the path set by Bitcoin and every other altcoin with red candlesticks.

As a result, the chances of recovery decline with every passing day, and even SOL holders lose hope.

Solana Investors React to the Drawdown

Solana’s price could struggle to note a recovery owing to the broader market cues. This is visible in the Moving Average Convergence Divergence indicator (MACD). The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

It is used to identify potential buy or sell signals based on the crossover of these averages. Solana’s MACD has been in a bearish crossover for over a month, indicating sustained downward momentum in its price trend.

The indicator suggests that the selling pressure on Solana remains strong.

Read More: How to Buy Solana (SOL) and Everything You Need To Know

As a result of this prolonged bearish signal, SOL holders are growing increasingly pessimistic about the coin’s short-term prospects. Many investors are adjusting their positions, anticipating further declines in Solana’s price.

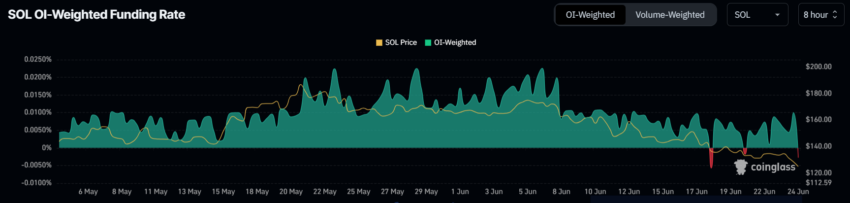

One significant indicator of this sentiment shift is the funding rate turning negative. A negative funding rate implies that short sellers are willing to pay a premium to hold their positions, betting on further price drops.

This is the third time the funding rate has turned negative this month, raising concerns about its gradual extent.

SOL Price Prediction: Breaking Supports

Solana’s price for the last month and a half has only been noting a downtrend, falling from $187 to $125. This drawdown resulted in SOL losing the support of the 23.6% Fibonacci Retracement at $128.

The altcoin is presently hovering at the $125 support floor, a level that has not been broken in the last three months. Thus, should SOL fall below it, the likely outcome will be a decline to $110.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

However, a bounceback could prevent further losses for SOL holders. The key resistance at the moment stands at $141, and flipping it into support would enable a rise to $151. Breaching this barrier would invalidate the bearish thesis completely.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment