US spot Bitcoin exchange-traded funds (ETFs) have achieved significant success, attracting $2 billion in new funds this month.

This surge emphasizes Bitcoin’s status as a leading digital asset that consistently appeals to both institutional and retail investors.

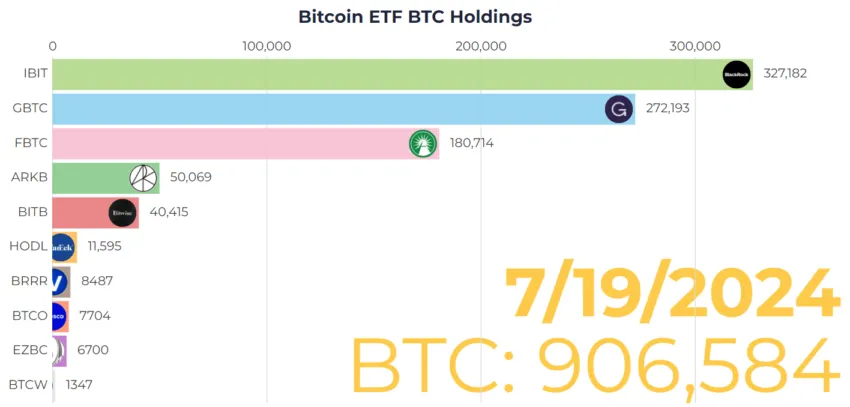

US Bitcoin ETFs Now Hold More Than 900,000 BTC

According to market data from Farside Investors, US-traded spot Bitcoin ETFs have attracted more than $2 billion in inflows since early July. The past week alone saw a strong cumulative net inflow of more than $1 billion across the 11 funds, marking the third consecutive week of net inflows.

Notably, these ETFs recorded inflows above $300 million thrice this week, with a record single-day inflow of $422.5 million on July 16, the highest in the past six weeks.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Moreover, the ETFs have reached a new milestone, with $17 billion in net flows over six months, surpassing Bloomberg analysts’ estimates of $15 billion over 12 months. Shubh Varma, Co-Founder and CEO of Hyblock Capital, emphasized the significance of these numbers in an interview with BeInCrypto, noting that the inflows indicate strong market demand and a renewed surge in investor interest.

“Interestingly, most of these inflows occurred within the last 30 days, signaling a recent surge in investor interest. This demonstrates growing investor confidence and participation, which can boost prices and market capitalization, promoting overall market growth,” Varma stated.

This remarkable influx has pushed the total number of BTC held by US-listed ETFs to a record of over 900,000 BTC, valued at more than $60 billion. Nate Geraci, President of the ETF Store, reported that these holdings represent 4.3% of BTC’s total supply.

Read more: What Is a Bitcoin ETF?

A breakdown of the holdings revealed that BlackRock’s IBIT holds the most Bitcoin, with 327,182 BTC valued at $21.79 billion. This is followed by Grayscale’s GBTC, with 272,193 BTC worth $18.1 billion, and Fidelity’s FBTC, which completes the top three with over 180,000 BTC valued at $12 billion.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment