Telegram-based project Toncoin (TON) has seen its market dominance subside despite outperforming Bitcoin (BTC) for most of the year. Before the latest bounce, TON encountered a challenging two-week period as the price fell by 15%.

Trading at $6.79 at press time, this analysis proves that the token may not be out of the woods just yet. Here are the reasons.

Whales Dump Toncoin, Raising Market Concerns

The major rationale behind Toncoin’s potential decline is the action of whales. Whales are entities or individuals that hold a large amount of a cryptocurrency’s circulating supply. Because of this, their actions and inactions influence prices.

According to IntoTheBlock, TON Large Holders’ Netflow has decreased by a whopping 97.05% in the last seven days.

This is in contrast to the large inflows some weeks back. Netflow is the difference between the large inflow and outflow. If the ratio is positive, it means whales have accumulated more than they have sold.

However, a negative ratio implies otherwise, which is true with TON. Furthermore, a careful examination shows that whales sold 1.4 million TON tokens between July 21 and 28. If this continues, the price of TON may erase some of its recent mild gains.

Read More: What Are Telegram Bot Coins?

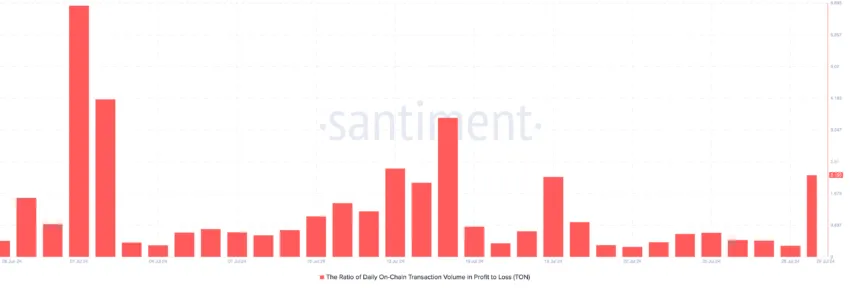

As a result of TON’s price bounce, the ratio of daily on-chain transactions in profit to loss reached its highest level since July 19. This metric shows whether token holders are realizing losses or profits. When it is negative, there are more realized losses than gains.

In Toncoin’s situation, the price increase has led to a rise in profit-taking. However, profit-taking usually leads to a decline, especially if the selling pressure increases. Therefore, if the ratio of on-chain transactions in profits to loss rises, TON’s uptrend could be halted.

TON Price Prediction: The Bounce Is Not Strong Enough

According to the daily chart, Toncoin’s price increase is not backed by vital indicators. For example, the Awesome Oscillator (AO) is negative. The AO measures market momentum and determines early changes in a cryptocurrency’s price.

When the AO is positive, momentum increases upward. However, if the indicator’s reading is negative, as it is with TON, momentum decreases. Another oscillator with a similar bearish bias is the Moving Average Convergence Divergence (MACD).

At press time, the MACD is down in the red region, reinforcing the possibility of a downtrend. If this continues, the price of TON may fall to $6.57. However, if selling pressure increases, the value could drop to $6.02.

Read More: 6 Best Toncoin (TON) Wallets in 2024

But if whales begin to accumulate more TON in contrast to what is currently happening, the value could rebound. If this were true, Toncoin’s price could jump to $6.90 and eventually reach $7.18.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment