Bitcoin’s deflationary model could prove vital for hodlers as World Bank officials warn of a probable global recession in 2023.

Economists from the Washington-based organization predict that global GDP growth will grow 1.7% in 2023, roughly 100 basis points less than the 2022 forecast of 2.9%.

World Bank Economist Says Worst-Case Now Baseline

Additionally, the economist responsible for the Global Prospectus Report said that the bank’s worst-case scenario six months ago is now its baseline, with further interest rate hikes set to tip economies over the edge.

“The world’s economy is on a razor’s edge and could easily fall into recession if financial conditions tighten,” said Ayhan Kose. The bank added that a 1% increase in global interest rates would cut its baseline GDP growth forecast from 1.7% to 0.6%.

The U.S. Federal Reserve will likely introduce less severe rate hikes this year than in 2022, which saw four increases of 75 basis points. Lower unemployment and wage growth in Dec. 2022 suggest that the U.S. economy is responding to the tightening policy, which investors hope will taper in 2023. The U.S. Consumer Price Index for Dec. 2022, which the Federal Reserve uses as an inflation indicator, will be released on Jan. 12, 2022. A lower number will mean that the Fed’s tightening policies are working, reducing the chance of aggressive hikes in 2023.

Even though economies may not technically enter a recession, the eurozone and the U.S. will likely experience a subjective slowdown, Kose said. Several factors, including Russia’s invasion of Ukraine, high-interest rates, high inflation, and lower investment, have contributed to the lender’s pessimistic predictions.

After severe contractions in developing countries during the pandemic, the World Bank expects investments in these regions to remain at 3.5%. It expects growth to stagnate until 2024.

Earlier this month, the managing director of the International Monetary Fund predicted that one-third of the world will undergo a recession in 2023.

Bitcoin Hodlers Should be Fine, Data Shows

Crypto investors hope that Bitcoin will fulfill its potential as a deflationary currency that defies central bank tightening efforts.

Every 210,000 blocks or four years, the Bitcoin algorithm reduces the issuance of Bitcoin for every successfully mined transaction block. This software mechanism helps control the asset’s scarcity. Higher demand propels Bitcoin’s price and increases miners’ incentives to continue securing the network. The algorithm currently rewards miners with 6.25 BTC for every successfully-mined block. That reward will drop to 3.125 BTC in April 2024.

Simply put, Bitcoin’s monetary policy is defined by software rather than a central authority.

While Bitcoin tracked equities markets downward for most of 2022, it hasn’t depreciated like the U.S. dollar over long periods.

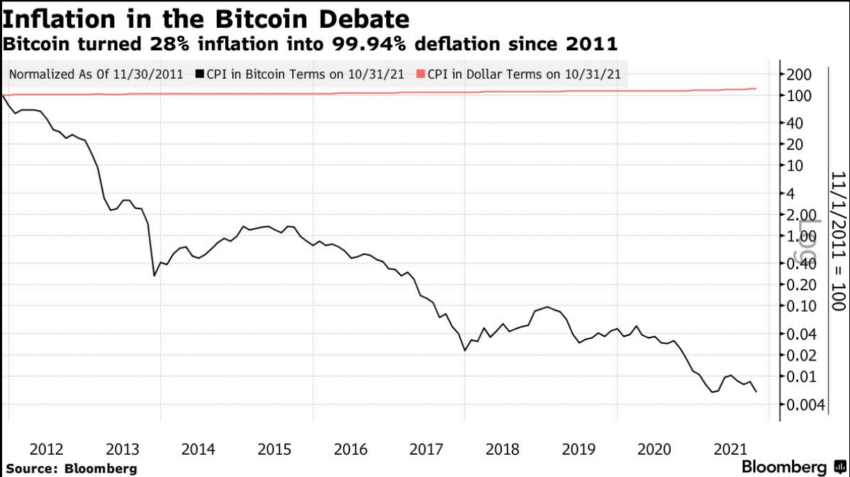

Between 2011 and 2021, data from Bloomberg shows that while the headline CPI (including food and energy costs) rose 28%, Bitcoin’s value declined in relation to CPI such that anything that cost 1 Bitcoin in 2011 cost 0.004 satoshis in 2021. One satoshi is one hundred millionth of 1 Bitcoin. In other words Bitcoin’s value increased as the dollar devalued.

Therefore Bitcoin hodlers with a five to ten-year time horizon before the recession will likely be the safest.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.

Be the first to comment