Solana wasn’t spared the hammering of early October. As of October 4, there are pockets of strength, but the downtrend remains. While the focus is on price, on-chain data shows that Solana is leading and dominating other blockchains.

Over 378,000 Tokens Minted On Solana

For the better part of the year, the upsurge of meme coin activity, drawn mainly by the low on-chain fees and higher scalability, has seen Solana trading volume across top decentralized exchanges like Raydium soar.

Confirming this surge, on-chain data, which summarized all activities in September 2024, shows that over 378,000 tokens were minted on the third-largest smart contracts platform. A majority of these tokens were meme coins.

It is no surprise that Solana leads in the number of tokens generated. Since the boom of H2 2023, which lifted SOL from around $20 to over $240 early this year, developers have poured into the platform, taking advantage of its high scalability.

Unlike Ethereum, it offers low fees without comprising security. Although reliability can be a concern, especially during high-demand times, Solana has been resilient recently and has not faced an outage.

The deployment of Pump.fun can explain the surge in meme coin activity. Data from Dune reveals that over 15,300 tokens were launched via the meme coin launchpad in the past 24 hours alone. Only 256 tokens graduated and were listed on Raydium, a DEX.

Considering the pace at which tokens are launched, it is no surprise that over 378,000 tokens hit the market in September alone.

Dominance In 3 Core Metrics But Trails Ethereum And Polygon On Volume

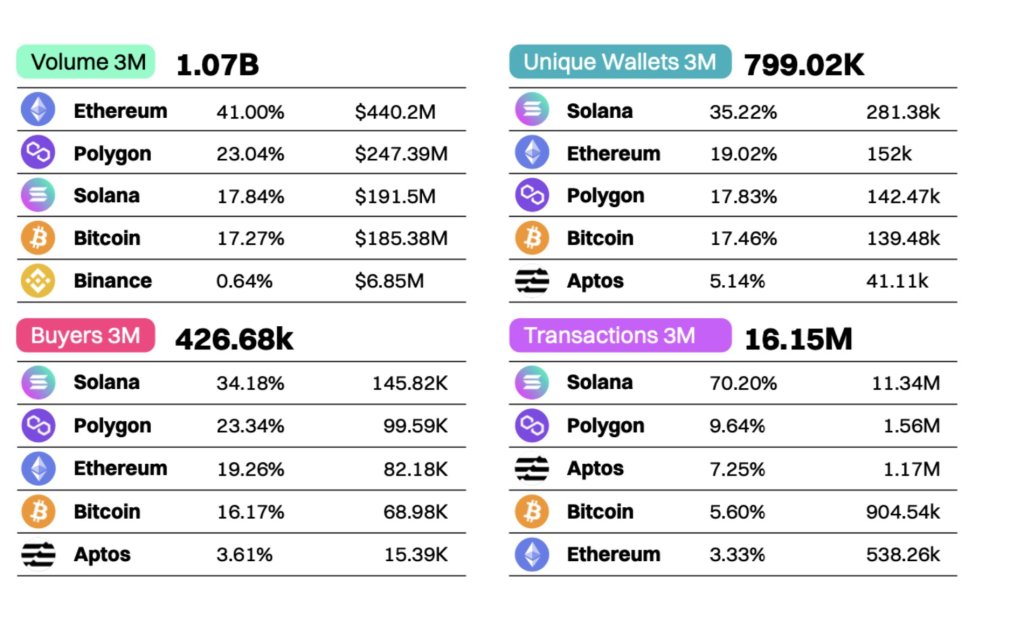

Additionally, a CoinMarketCap report notes that the modern chain ranks as the most active network in three core metrics. According to the coin tracker, Solana boasts the highest number of buyers, transactions, and unique wallet addresses. Positive as this may be, a big portion of this can be attributed to bot activity.

Although the network leads in transactions, buyers, and unique wallets, it trails Ethereum and Polygon in trading volume during this period. Ethereum is by far the largest smart contracts platform by market cap, and even looking at DeFi activity, it is gaining traction.

Meanwhile, Polygon, which hosts Polymarket, the predictions market, is generating volume ahead of the hotly charged general elections in the United States.

Feature image from Canva, chart from TradingView

Be the first to comment