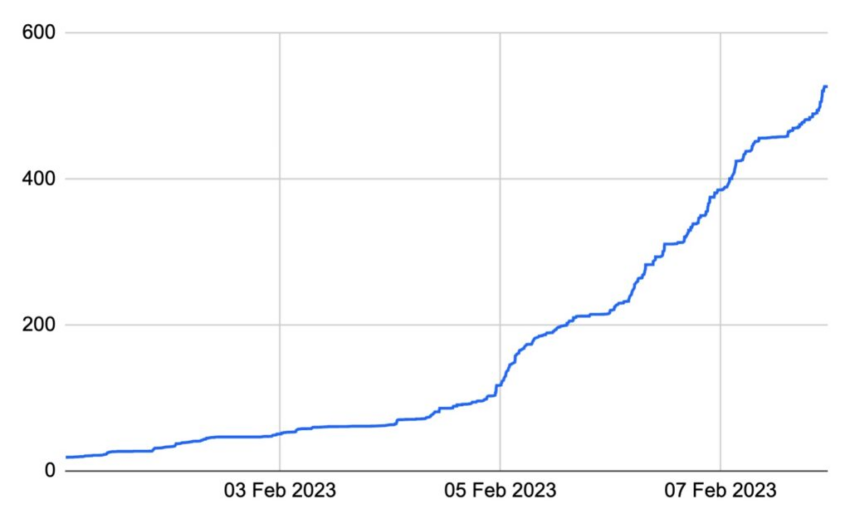

Ordinals NFTs have pushed transaction fees on the Bitcoin network to the highest levels since November 2022, shows on-chain data from IntoTheBlock.

Transaction fees on the Bitcoin network have doubled in the past two weeks, going from $0.77 on January 29 to a high of $1.95 on February 10. The blockchain’s median transaction fee has also increased to $0.73 from $0.25 on January 30. CryptoQuant also noted that Ordinals NFTs transactions had increased network activity to May 2021 levels when China banned crypto.

Ordinals NFTs Popularity Soars

The rise in Bitcoin network fees coincides with the increased interest in Ordinals NFTs. A recent report by BitMEX Research revealed that over 10,000 NFTs were minted between December 14 and February 7. During this period, Ordinals NFTs have taken up 526 megabytes (MB) of block space, with creators spending 6.77 BTC on Ordinals-related transactions.

Interest in the NFTs has also seen their value rise to new highs. NFT Now reported that some of these NFTs had been sold for as high as 11 BTC due to the skyrocketing demand.

Still, not everyone is pleased with the growth of NFTs on the Bitcoin network. One such critic is lightning network developer Rene Pickhardt. Pickhardt believes people are “wasting precious block space by spamming jpegs.”

Pickhardt’s remarks cannot be ignored because Ordinals NFTs have consumed over 70% of Bitcoin’s total blockspace despite only accounting for about 3% of the complete transactions, according to BitMEX research.

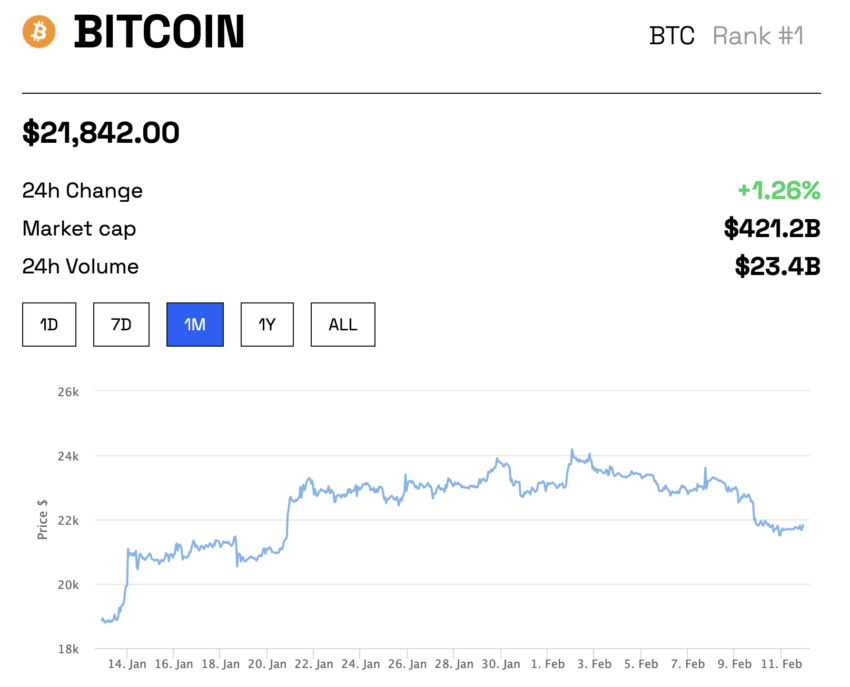

Bitcoin (BTC) Price Falls Below $22,000

Despite the rising interest in Bitcoin Ordinals NFTs, BTC price dipped below $22,000 after trading at a high of $24,300 on February 2. The 12% nosedive coincides with the US Securities and Exchange Commission’s (SEC) enforcement action against the crypto exchange Kraken.

BeInCrypto’s Global Head of News, Ali Martinez, pointed out that a spike in buying pressure followed the recent price correction. Martinez affirmed that traders on Binance Futures appear to have bought the dip. Roughly 62% of all accounts on Binance Futures with an open BTC position were going long.

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Be the first to comment