Litecoin price hovers around $63 with the altcoin down over 5% in the past week and 11% over the last 30 days.

According to CoinGecko, LTC has fallen 84% since hitting its all-time high above $410 in May 2021.

The downtrend that has seen one of the earliest cryptocurrencies slide out of the top 10 by market cap now has small wallet holders selling as price nears a crucial support area.

Market intelligence and on-chain analytics platform Santiment has highlighted a dip in Litecoin shrimp holders – wallet addresses with less than 1 LTC. These wallets have sold-off over 45,200 LTC, but analysts say this could be a “turnaround.”

“Litecoin has not been lighting social forums on fire with its market value dropping -36% since its April 1st peak. A sudden liquidation of 45.2K net 0.1-1 LTC wallets indicate that small traders are finally capitulating out of the OG crypto asset. Small fish impatiently ‘jumping ship’ is often a turnaround sign for an asset to begin turning bullish once again,” Santiment analysts wrote on X.

76% of Litecoin wallets in loss

In the past few months, the selling has coincided with price dipping from above $110 in early April. After bouncing from lows of $56 following the crypto crash on August 5, Litecoin is back below $64 and near the major support zone around $60.

Per IntoTheBlock, the In/Out of the Money indicator is largely bearish. About 76% of addresses are in loss at current price and only 18% are in profit. Notably, 22% of addresses have held LTC for less than a year and could be part of the capitulating small holders.

However, 78% of wallets have held the altcoin for more than a year.

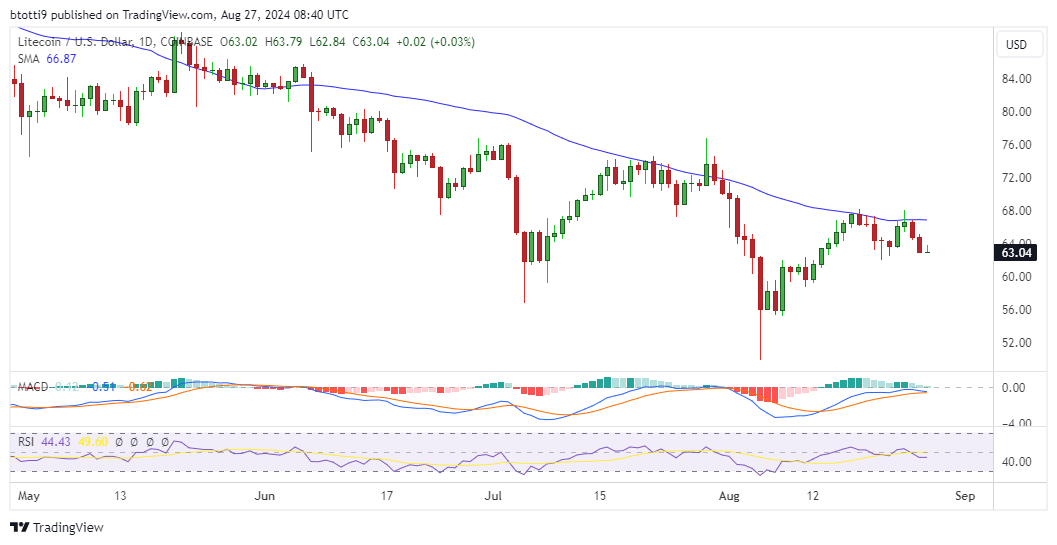

Litecoin price chart

0n the daily chart, both the RSI and MACD indicators suggest bears might push Litecoin price lower.

The price is below the 50-day SMA, which could act as the primary resistance level around $66. On the other hand, further weakness could see LTC seek the demand reload zone around $55.

Be the first to comment