How Bitcoin mining can improve grid efficiency, encourage renewable energy adoption, and create a more sustainable financial system despite Greenpeace’s critique.

Demand response programs have become crucial in balancing electricity supply and demand. Essentially, they improve grid efficiency and integrate renewable energy sources as the world moves towards cleaner technologies. Surprisingly, Bitcoin mining can play a significant role in these programs, leading to a more sustainable and efficient financial system.

However, not everyone is on board with this idea, as evidenced by Greenpeace’s recent campaign against Bitcoin’s climate impact.

Greenpeace’s “Skull of Satoshi” Artwork

In an attempt to raise awareness about the environmental impact of Bitcoin mining, Greenpeace partnered with art activist Benjamin Von Wong for its ongoing “change the code, not the climate” campaign. It aims to convert Bitcoin’s consensus mechanism to a more eco-friendly proof-of-stake (PoS) model.

On March 23, Greenpeace revealed its commissioned art piece, dubbed the “Skull of Satoshi.” The “Skull of Satoshi” is an 11-foot-tall (3.3 meters) skull featuring the Bitcoin logo and red laser eyes.

Made of recycled electronic waste, the skull is adorned with “smoking stacks” to symbolize the “fossil fuel and coal pollution” caused by Bitcoin mining and the “millions of computers” used to validate network transactions.

Balancing the Grid with Bitcoin Mining

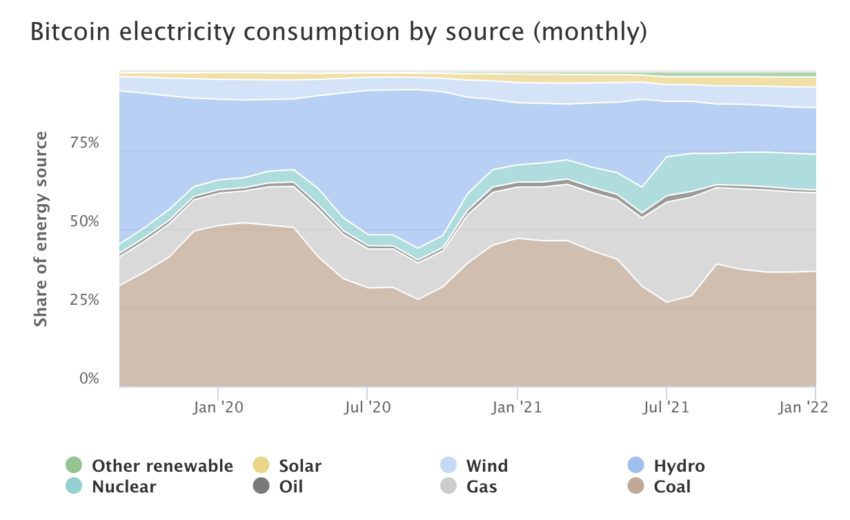

Despite the controversy surrounding the environmental impact of Bitcoin mining, it has the potential to contribute positively to environmental efforts.

During periods of high electricity demand, supply is often stretched thin, resulting in increased costs and potential grid instability. Conversely, excess energy, especially from intermittent renewable sources like solar and wind, can go to waste during low-demand periods. Bitcoin mining offers a solution to this problem.

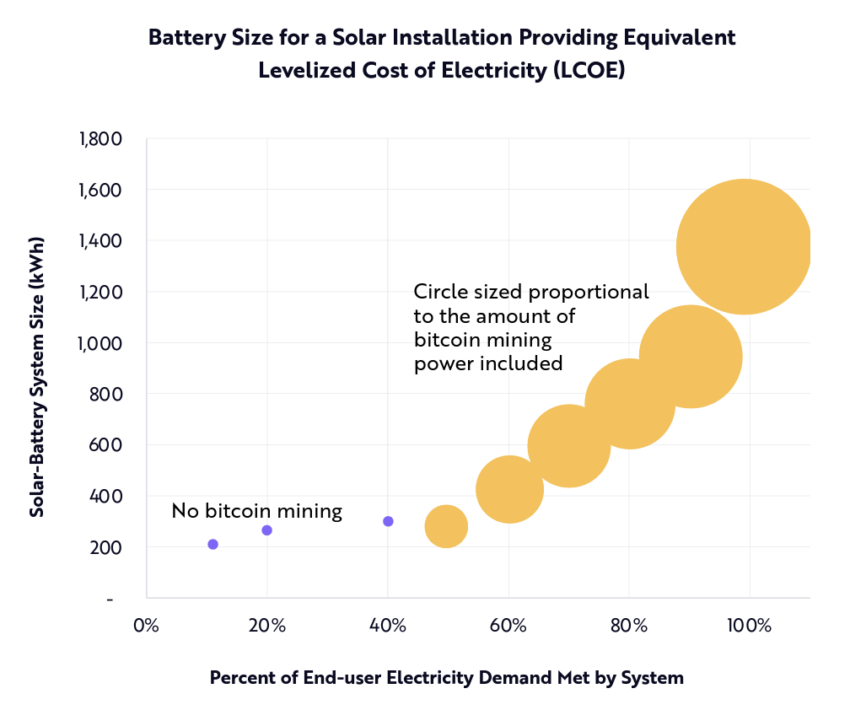

ARK’s research suggests that expanding a solar system’s battery capacity by 4.6 times and integrating a Bitcoin mining operation could meet over 99% of consumer demand while maintaining profitability.

With its on-demand energy consumption, Bitcoin mining can function as a flexible load, adjusting energy usage based on grid conditions.

By participating in demand response programs, miners help absorb excess energy during low-demand periods, effectively acting as a “battery” that stores energy in the form of digital currency. This process helps balance the grid and promotes the adoption of renewable and existing natural energy sources.

Fred Thiel, CEO of Marathon Digital Holdings, a Bitcoin mining company with a wind-powered facility in West Texas, said:

“If we want more and more renewable energy to be built in this country, we need to provide a load that allows them to properly monetize that generation capacity. Bitcoin mining is the perfect load for renewable energy.”

An Efficient and Environmentally Friendly Financial System

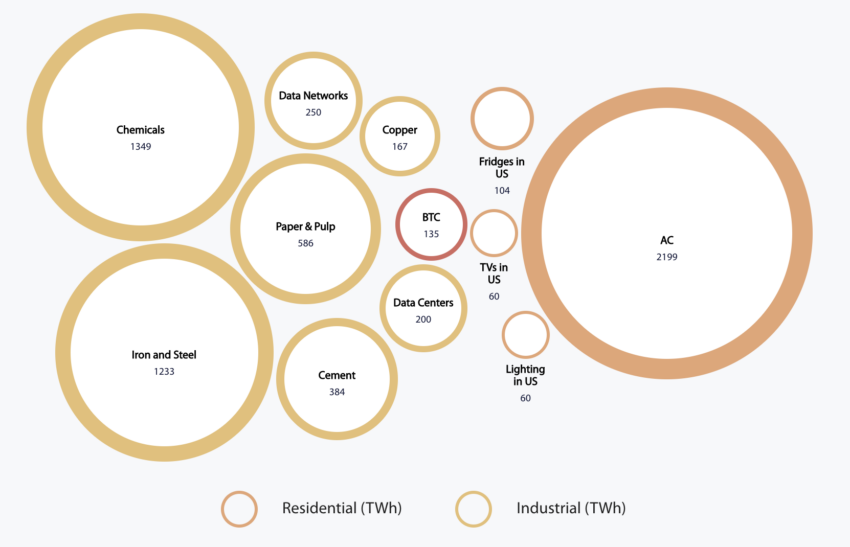

In addition to the environmental benefits, Bitcoin mining contributes to a more streamlined financial system. Traditional fiat-based banking and financial infrastructure require vast resources, including millions of employees, thousands of branches, data centers, and energy consumption.

In contrast, the Bitcoin network serves as a decentralized financial backbone, demanding far fewer physical resources and personnel to operate.

Bitcoin’s decentralized nature eliminates many intermediaries in the financial system, reducing overhead costs and streamlining processes. This is why Charles Hoskinson, co-founder of Cardano, believes that “crypto needs to de-risk itself from those unstable and volatile banks.”

A 24/7 Global Financial Network

The Bitcoin network operates 24/7, offering near-instantaneous global settlements. This is unlike the slow traditional financial system that can take days to clear and settle transactions across borders.

According to Cathie Wood, CEO of Ark Invest, as the US banking system faced turmoil due to bank runs jeopardizing regional banks, Bitcoin, Ethereum, and other cryptos continued to function smoothly. The instability in the banking system posed a threat to stablecoins, which serve as gateways to DeFi.

The increased efficiency of the Bitcoin network translates to reduced energy consumption per transaction. For this reason, transitioning to a Bitcoin-based financial system could result in significant energy savings. The computational power needed for mining is less resource-intensive than maintaining the existing financial infrastructure.

Wood maintains that regulators ought to concentrate on the centralized and non-transparent weak spots within the traditional banking system rather than impeding the progress of decentralized, transparent, and accountable financial platforms that lack central points of failure.

As the Bitcoin network continues to mature and gain acceptance as a global financial system, its potential to improve grid efficiency and reduce overall energy consumption will become increasingly apparent.

Despite the skepticism voiced by environmental groups like Greenpeace, Bitcoin mining has the potential to play a pivotal role in the future of energy and finance.

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.

Be the first to comment