Spot Ethereum ETFs recorded a robust trading debut in the US on July 24 after months of speculation and regulatory uncertainty.

The ETFs recorded an impressive volume of $1.11 billion on the first trading day, led by BlackRock’s $266.5 million inflows. Within the first 90 minutes of trading, ETH ETFs recorded $361 in trading volume, reflecting strong interest and confidence in Ethereum.

While the first-day trading volume for Ethereum ETFs still represents around a quarter of the volume Bitcoin ETFs saw upon launch, it’s still a major development for ETH. Aside from a brief spike in spot price, the surge in interest for ETFs has also affected the derivatives market.

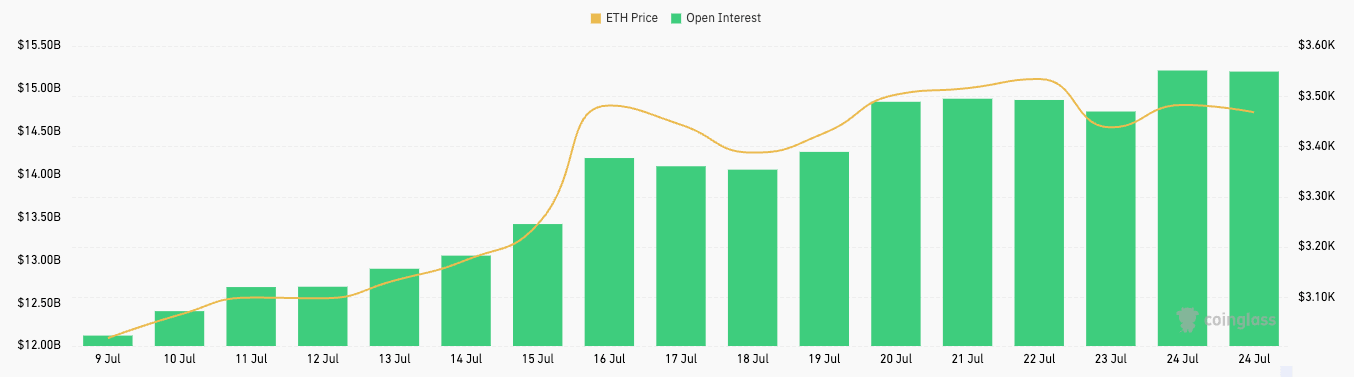

Ethereum derivatives saw a volatile June but had a relatively calm July. Over the past week, the entire derivatives market saw gradual but noticeable growth that seems to have sped up after the ETFs launched. Data from CoinGlass showed a steady climb in options open interest, particularly on July 24, when it reached $7.39 billion.

Ethereum futures followed a similar trend, albeit the larger size of the market meant that the $460 million increase in open interest didn’t show up as such a significant uptick.

A rise in open interest is significant as it often brings about increased liquidity and trading volume, providing Ethereum with a more robust market structure. As the trading activity around ETH ETFs heats up in the coming weeks, we can expect the derivatives market to continue its upward trajectory.

The growing institutional interest in ETH ETFs could very well translate into derivatives. Institutional and sophisticated investors could begin employing basis trade strategies, leading to an increase in derivatives OI and volume.

Basis trading is a sophisticated strategy that involves taking advantage of the price difference between the spot and futures market. It has become a significant part of the Bitcoin market, especially after the launch of Bitcoin ETFs. Previous CryptoSlate analysis found that the Bitcoin basis trade has significantly influenced the market, leading to flat price action that defies the inflows and volume seen in spot ETFs. With the introduction of Ethereum ETFs, a similar thing could also happen in the ETH market.

While this trading strategy suppresses any significant price action, it could bode well for Ethereum by increasing OI, creating a more liquid and active derivatives market. Such a market enhances price discovery and risk management capabilities.

However, if a basis trade involving Ethereum ETFs and derivatives gains a lot of traction, it could negatively affect the market. The most significant risk for Ethereum comes from the potential for market manipulation, where large institutional players could exploit discrepancies to manipulate prices.

Furthermore, if the basis trade becomes too crowded, it could reduce the strategy’s profitability, leading to abrupt exits and potentially triggering sharp corrections. Given the size of Ethereum’s DeFi market, this could prove especially dangerous for the coin.

The post Ethereum open interest grows as market hype grows around spot ETFs appeared first on CryptoSlate.

Be the first to comment