Ethereum Merge is here. Even before its official launch many debates have arisen, and they will remain alive long after the Merge.

Ethereum’s switch to Proof-of-Stake (PoS) could be considered one of the most significant events in the crypto universe. Speculation and misinformation have flourished. Here, we will discuss the facts and the consequences of this technological experiment.

It is important to emphasize that the decision for developers to switch from their original consensus protocol, Proof-of-Work (PoW), to PoS has been several years in the making. Beacon Chain, the Ethereum blockchain branch responsible for using PoS, was originally shipped on December 1, 2020, for development and testing.

It is indisputable that the transformation from PoW to PoS will cause changes in the perception of Ethereum as a network. There are many views to consider: economic, environmental, tokenomics, competition against other cryptoassets, legal, centralization versus decentralization… Ultimately, the change to PoS is a turning point for the blockchain, as well as for the entire crypto community.

Ethereum becomes sustainable, Bitcoin stands alone

Implementing PoS as a consensus mechanism will lead to a radical reduction of the energy that Ethereum’s blockchain will need.

Several studies conclude that Ethereum will consume 99.95% less electricity after implementing PoS, thanks to Merge. This fact is impossible to ignore and will attract investment.

The first event that will occur after the implementation of PoS will be the plummeting of Ethereum’s hash rate to zero, thus representing the end of an era. Any user who has ETH in their possession will be able to become a validator. They will also be able to capture a return by leveraging their equity by staking in the protocol.

An immediate effect of the transformation will be how media pressure will focus even more on Bitcoin and the alleged environmental damage it causes. Investors not fond of the use of PoW were hesitant to invest in Ethereum. For example, Tesla backed out of its initial bid to institute Bitcoin as a means of payment, due to the crypto’s carbon footprint.

With PoS, Ethereum has a clear path for any investor. This is especially true for investors who must follow the ESG standard, to inject capital into ETH, or who are investing in companies related to Ethereum’s activity.

In this way, Bitcoin remains a media target, while Ethereum is spared from one of the most controversial issues of recent years regarding cryptocurrencies.

Regulators will have fewer arguments to target Ethereum

It is common knowledge that regulators have long wanted to intervene or put certain basic rules on the crypto market. On the one hand, it seems that due to the small size of the crypto market, they have not been forced to intervene. But on the other hand, they have observed how prolonged growth among new generations could endanger their national currencies. And therefore, their sovereignty over money.

Regulating cryptocurrencies is not a simple task, due to the great versatility between projects. Due to complexity, regulators must start somewhere. Sustainability concerns seem to have been the argument chosen to exercise regulation over cryptocurrencies.

Proof-of-Work has been the reason for attack, with regulators flirting with banning it. The claim is that the mining of cryptocurrencies through PoW should be banned due to the high electricity consumption it represents.

From Europe this idea has been toyed with through the MiCA although it has finally been delayed. In the United States the debate is open. There are reports, such as the most recent one from the White House, which warn about the danger of an accumulating carbon footprint.

In that report Ethereum was singled out for being responsible for 20-39% of the electricity expenditure derived by mining cryptocurrencies. Bitcoin was estimated at 60-77%. Due to Ethereum’s move to PoS regulators will not be able to use this argument against the blockchain. This provides a veil of reassurance for the crypto industry that has been built on Ethereum.

Exodus of Ethereum miners: Who will benefit from it?

What will happen to the miners who have been mining Ethereum on a day-to-day basis? As with Bitcoin, there is specific mining equipment designed to mine ETH. When Ethereum switches to using PoS as a consensus model, Ethereum mining will disappear completely and the hash rate will drop to zero.

Several Ethereum mining groups have tried to boycott the event seeking to abolish the EIP-1559 or have threatened with a new Ethereum fork. Their efforts seem to have been in vain but show the discontent of relevant players in the crypto industry.

Ethereum Classic, the original blockchain, will continue to operate using PoW. Migrating from Ethereum to Ethereum Classic seems the simplest solution, as Vitalik Buterin has already pointed out.

Ethereum Merge and Bitcoin

Or perhaps a migration from Ethereum PoW mining to Bitcoin PoW mining, is a good idea. To answer this BeInCrypto contacted Anibal Garrido, a cryptoasset advisor and trading and mining expert.

Regarding the final destination of Ethereum miners, Garrido confirmed that they will probably not cease their activity. But, they “will migrate to other projects where mining can offer sufficient returns to continue with the mining activity.” Examples are, “RavenCoin, Conflux, Ethereum Classic among others.”

The equipment of Ethereum miners will not become entirely obsolete, says Garrido.

GPUs that work with Ethereum can be configurable to other projects that support Etash or Dagger Hashimoto (Ethereum’s Proof of Work base) without any drawbacks.

Asked if there will be an exodus of Ethereum miners to Bitcoin, Garrido replied:

Ethereum hardware (GPU) is not profitable for BTC due to the current difficulty level of the Bitcoin network. Years ago BTC miners abandoned GPUs and migrated to powerful ASIC technology, which makes GPU mining unprofitable due to the disadvantageous ASIC superiority of processing trillions of operations per second far above GPU processing.

In addition to a problem of profitability, there is also a technical aspect that could pose a great obstacle due to the incompatibility between the two networks:

ETH ASIC miners will also have problems due to incompatibility of algorithmic standards. For example, the powerful E9 ASIC miner will not be able to be used after the Merge for BTC, as it is only compatible with the Etash algorithm (ETH) and not SHA256 (BTC).

An exodus of Ethereum miners to Bitcoin’s network is therefore out of the question. However, the mining migration from the Ethereum network to other PoW blockchains will certainly be worth watching.

Layer 1 solutions will lose a distinguishing value feature

One of the collateral effects of Ethereum’s conversion to PoS will fully affect blockchains that compete against Ethereum’s hegemony, the so-called “Ethereum Killers.” Among the layer 1 solutions, we can find Solana, Cardano, Avalanche, Tron, Polkadot or Radix just to name a few.

Many of these cryptoassets have reaped collateral rewards due to Ethereum’s move to PoS. Their tokens have re-emerged to the upside in the midst of the crypto winter. However, both Layer 1 and Layer 2 solutions, such as Polygon, will lose one of their strongest selling points to the Ethereum behemoth: sustainability. For example, Starbucks chose to launch its NFT video game on Polygon especially because of its sustainable blockchain, now that argument will change for good.

Ethereum 2.0 will force these protocols to change their marketing pitch to focus on other types of qualities where Ethereum still falters. Examples are the high cost of network saturation fees, and especially the one that can best address the everlasting problem of scalability.

Ethereum has a large user and developer base, so this battle will be hard to fight. However much can change, especially in the crypto universe. It is very likely that Ethereum and the other L1s and L2s end up in the future working in an entangled ecosystem.

Ethereum Merge: NFT industry is now clean

One of the sub-industries of the crypto sector that has suffered the most from the burden of using unsustainable technology is the NFT sector and its derivatives.

The non fungible token (NFT) sector is a somewhat more politicized and environmentally conscious. Currently, NFTs are used in a wide range of applications from video games, sports or music among others. However, the use-case that launched them into the mainstream was crypto art.

There has always been debate in this sector about the use of Ethereum to host and create the NFTs of artworks, because of the carbon footprint. Now, the crypto art sector will be able to breathe more easily.

Ethereum Merge: Centralization as a threat

Ethereum’s move to PoS is going to change its tokenomics, and it could affect Ethereum’s decentralization.

Detractors of using PoS for Ethereum cite that this system will ultimately cause the Ethereum network to become centralized. Big investors will be able to absorb large amounts of ETH, eventually dominating much of the network. The deep-pocketed investors are real, for example GrayScale bought almost all of the ETH mined during a phase when it launched its Ethereum fund.

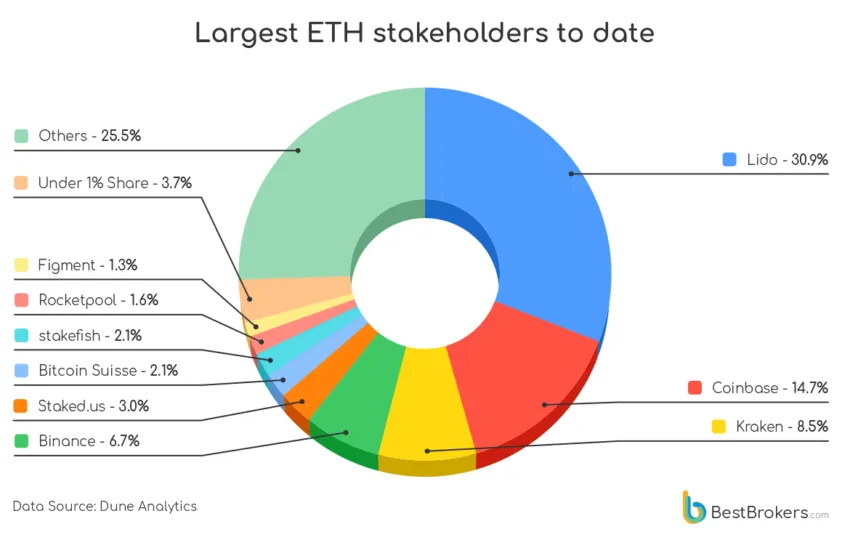

The existing fear is that Ethereum will become even more centralized. Let’s look at data from Dune Analytics, a public blockchain data collector platform. Lido has the largest ETH stake with 4,152,128 Ether in staking or almost 31% of the total pool. This amount would be equivalent to 129,754 validators, as each of them needs to stake 32ETH on the Beacon chain, the staking blockchain that will eventually join Ethereum to transform it to Ethereum 2.0.

Therefore, it can be concluded that 29.61% of ETH in staking is dominated by three crypto exchange platforms. The total amount in staking of the first 4 players mentioned is 8,160,416 ETH or 60.69% of all ETH in staking.

The problem with this centralization is that investors or companies holding these large amounts of money could be attacked by freezing their funds, thus affecting the Ethereum network. This was previously not a concern to be considered. However, the sanction against Tornado Cash has opened the pandora’s box and set a “dangerous precedent” according to Charles Hoskinson, creator of Cardano.

The consequences may be unknown, but it is a fact that Ethereum’s PoS move will cause a shock to Ethereum’s decentralization in one way or another.

Ethereum Merge should matter to every crypto user

Indeed, the Ethereum Merge and the move from PoW to PoS could be the most relevant event of the year. And, of the crypto industry since Bitcoin and Ethereum were born.

On the one hand, this global experiment could set a precedent among cryptocurrency developers. If successful, it could even convince Bitcoin maximalists to make a change to their consensus model. On the other hand, the experiment may be a failure and erase part of Ethereum’s original identity.

It is worth remembering that without experimentation, one does not evolve. Good luck Ethereum.

Got something to say about the Ethereum Merge or anything else? Join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Be the first to comment