“The collapse of crypto shadow banks like Celsius demonstrated just how problematic centralized, opaque finance can be,” says Sunny Aggarwal of Osmosis DEX.

Centralized finance platforms have taken a huge credibility hit due to poor risk controls, but decentralized finance protocols haven’t escaped unscathed either. So, is DeFi or CeFi likely to emerge stronger from this current period of turmoil, or is the future likely to see some sort of hybrid of the two?

In November 2021, Zhu Su, co-founder and chief investment officer of hedge fund Three Arrows Capital (3AC), was a big name within the CeFi industry. Having just closed a purchase of more than $400 million worth of Ether using the fund’s assets, together with his friend Kyle Davies, the two had become among the world’s largest crypto holders.

As a crypto bull market mesmerized the attention of return-hungry investors, funds poured into the Singaporean-based 3AC. After all, all investors had to do was to make a wire transfer, sit back, relax and enjoy the fat returns generated by the hands of “professionals,” right?

Fast forward just eight months later, both Su and Davies are in hiding after the collapse of the firm blew up the CeFi sector and wiped hundreds of billions off the overall market cap. A court in the British Virgin Islands ordered 3AC’s liquidation with an estimated $2.8-billion hole in the balance sheet.

It turned out that a series of highly leveraged directional bets made by 3AC went horribly wrong as the crypto bear market intensified in May, wiping out what’s likely to be all of its investors’ capital. 3AC had taken large loans from all the big CeFi lenders — Voyager, BlockFi and, to a lesser extent, Celsius, leaving them all exposed, too.

Crypto-brokerage Voyager Digital reportedly lent $665 million to 3AC for trading purposes. It issued a default notice to no avail, and the firm was forced to file for bankruptcy. Crypto broker Genesis recently announced it will cut a fifth of its staff and replace its CEO after lending $2.4 billion to Three Arrows Capital. BlockFi suffered huge losses after liquidating 3AC; Finblox closed withdrawals; Derebit filed a liquidation application; and Blockchain.com got stung for $270 million and laid off 25% of its staff.Celsius Network wasn’t as affected directly by 3AC, as it only had $75 million in loans outstanding to the fund. However, falling crypto prices and a bank run following the collapse of Terra and ongoing contagion saw its net assets swing to negative $2.85 billion and was forced to halt withdrawals from more than 1.5 million customers indefinitely. It’s currently trying to trade its way out of bankruptcy.

This is literally the best advert for DeFi we could ever hope for. pic.twitter.com/BZQm6Ntzav

— drnick 🗳️² X 🏴 (@DrNickA) July 19, 2022

How did DeFi perform?

Decentralized finance, or DeFi, has performed a lot better at least in terms of contagion and by and large kept chugging along. Just before the crypto crash this year, never before seen developments, such as collateralized peer-to-peer lending, decentralized exchange swaps and liquid staking, led many crypto enthusiasts to believe that the world was on the brink of a new decentralized finance revolution.

Within a span of two years, the total value locked in DeFi projects had gone from nothing to over $300 billion. Heck, even traditional financial institutions (TradFi) skeptical of blockchain, such as the Bank of International Settlement, praised the technological innovations brought forth by DeFi.

However, investors’ confidence was harmed by the collapse of Terra and further shaken by ongoing hacks, which saw losses of $678 million during the second quarter of 2022 alone. Malicious actors, such as North Korea-backed Lazarus Group, have wreaked havoc in the sector by finding clever and intriguing new ways to break into critical smart contracts and draining them of users’ funds. Axie Infinity, a popular nonfungible tokens monster battle game, saw its Ronin cross-chain bridge lose $612 million in just one single Lazarus exploit earlier this year.

It’s no doubt that opacity regarding investors’ money along with poor risk management and a lack of accountability has severely damaged CeFi’s reputation. But many crypto investors’ who weren’t big fans of custodied funds in the first place did not expect DeFi to fall so hard so quickly as well.

The cryptocurrency bear market has led to the value of certain DeFi tokens falling more than 90% within months, while some have been completely wiped out. Even reputable “blue chip” projects, such as lending protocol Aave, decentralized exchange Uniswap and stablecoin liquidity platform Curve, could not shield their tokens from the bloodbath, falling 60%–70%.

Losing funds through bugs, poorly written code and security exploits have dealt severe blows to confidence in the emerging sector. And the recent sanctions against Tornado Cash have revived concerns over the decentralization of Ethereum. So, how likely is it that crypto enthusiasts’ visions of a decentralized future will recover?

Secure the funds

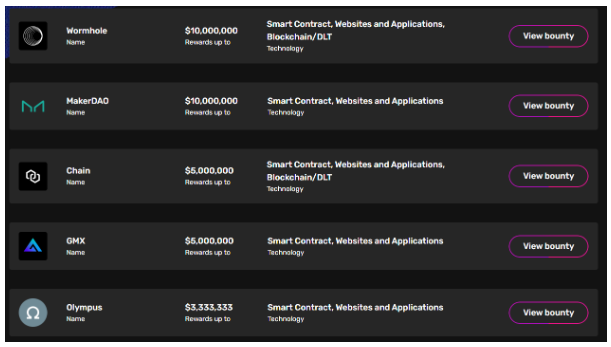

Luckily, talented developers and savvy project leaders are already on their way to addressing DeFi’s shortcomings, which were learned through the market downturn. Immunefi is a bug bounty and security services platform that has paid out over $40 million in bounties to white hat hackers. It currently offers bounties on over 300 DeFi and crypto projects that hold an estimated $100 billion in user funds.

Immunefi CEO Mitchell Amador said security expertise is sorely lacking in the DeFi sector, and this lack of more profound knowledge means that many developers launch projects by simply copying and pasting code from other projects.

When one of these projects has a vulnerability, others also have that vulnerability. This is a vulnerability peculiar to crypto rather than centralized Web2 firms. He says, “The Web3 industry is unique because smart contract vulnerabilities can mean a permanent loss of funds.”

With billions of dollars in user funds locked in smart contracts, black hat hackers can study those contracts, discover where they’re vulnerable, and exploit them simply due to their transparent, open-source nature. In addition, state-backed hacker groups, such as Lazarus Group from North Korea, are also dedicating a lot of resources to plundering protocols.

The problem is especially focused on cross-chain bridges, which tend to have much more moving parts than regular decentralized applications and are also riddled with complexity and a lack of standardization. Having far more funds locked up also makes them an “ideal” target for hackers.

Bounties posted by Immunefi and protocols have encouraged whitehat hackers to “ethically” exploit protocols to fix problems before funds are lost. In June, Ethereum bridging and scaling solution Aurora paid out a $6-million bounty to ethical security hacker pwning.eth via Immunefi. The protocol could have suffered a $200-million loss had malicious attackers decided to capitalize on the vulnerability.

Not all cross-chain bridges are created equal. Sunny Aggarwal, co-founder of Osmosis DEX, says that such hacks mostly occur on Ethereum Virtual Machine-connected bridges and not on the inter-blockchain communications protocol (IBC) that runs on Cosmos.

“The major bridge hacks are a reminder to victims that bridges are, in fact, too brittle to be allowed to custody significant amounts of capital at this stage in their lifecycle. Nearly 50 blockchains use IBC to conduct over 10 million IBC transactions daily, across an ecosystem with over $1 billion assets in it.”

“It’s a fully trustless system,” Aggarwal comments. “I think the future has never been brighter for DeFi. Protocols such as Terra Luna were positioned with binary success; it was either going to fail or be wildly successful due to its extremely risky dual-token conversion design. But in the end, the Terra meltdown proved that IBC works as promised and was a helpful stress test for Osmosis as a whole.”

For Aggarwal, the entire point of this industry is to allow such experimentation to happen so that builders and researchers in the space can continue to iterate, integrating the things that work and blacklisting those that don’t. “This way, the technology will ultimately improve across boom-and-bust cycles as time goes on.”

Why not both?

Neither CeFi nor DeFi is going anyway, so the future is likely to contain a blend of both.

SEBA Bank is a crypto-first custody bank licensed by the Swiss Financial Market Authority (FINMA). Matthew Alexander, head of digital corporate finance and asset tokenization at SEBA Bank, tells Magazine that more traditional financial institutions will want to engage with open and decentralized finance if rates on loans are comparable or better than TradFi, which will attract much more liquidity to the ecosystem.

Daniel Oon, head of DeFi at Algorand, also believes that there’s huge potential in integrating DeFi with TradFi concepts, but the emphasis needs to remain on decentralization.

“I would say the industry will witness a new growth spurt within the next year or so. Right now, services such as borrowing and lending are overcollateralized. And a move into loans collateralized on decentralized trust could have huge effects in the future.”

The concept of fractional collateralized deposits for decentralized lending, as opposed to full collateralization, could, in theory, be aided by DeFi’s inherent nature of transparency. Unlike CeFi products, DeFi protocols usually provide real-time updates to applicable profits, losses, total value locked, token emissions and project reserves.

“This transparency contrasts with opacity we witnessed in CeFi, where it’s been a major contributing factor in the meltdowns, troubles and scandals that many CeFi products are experiencing during the market downturn,” says SEBA‘s Alexander.

Due to strict regulations, institutional investors are often prohibited from accessing “wild west” financial products in DeFi. But custodians such as SEBA Bank are helping to bridge that gap. Cryptocurrencies held with SEBA can be traded 24/7 against fiat currencies while gaining exposure to DeFi yields. More importantly, the Swiss Deposit Protection Scheme also guarantees the fiat funds in clients’ accounts used for trading.

Nah, let’s go DeFi

For true believers in decentralization, nothing beats pure DeFi, though. Marvin Bertin, partner and chief scientific officer of Genius Yield — a DeFi protocol operating on the Cardano blockchain — thinks that a decentralized financial system will be much more inclusive. Bertin points out that profits generated by DeFi protocols will often trickle down to users themselves:

“Take the example of traditional banks. Customers deposit their fiat money into accounts where they receive interest of 0%–1%. The same banks then lend out customer funds at 10x or greater. Many people use these institutions because they don’t have a choice. DeFi can allow customers to lend out their savings to other customers, essentially capturing this profit themselves instead of giving them to big CeFi institutions.”

Ironically, of course, that is very similar to the one that Celsius founder and CEO Alex Mashinsky would often make to explain how the protocol returned such high yields to depositors. In January 2021, he told Magazine, “DeFi, CeFi, it doesn’t matter what you call it. Everybody is chasing yield because central banks and commercial banks are just not paying you anything for your money.”

“All we’ve done is basically use some of the best ways that Wall Street created to earn yield or extract value out of capital,” he added.

Hopefully, transparent and truly decentralized platforms will be able to avoid a similar fate to the risk-taking, centralized and now bankrupt Celsius.

Bertin says another advantage of DeFi is that many people are eliminated from funding startups or other ventures because they don’t have a high enough net worth. He says this is government-mandated in many developed countries and gives special privileges to people of a higher financial status. But in DeFi (at least in theory), anyone with an internet connection can access financial services, thus breaking down the usual barriers.

DeFi offers new and innovative ways to access finance, and some protocols are even experimenting with ways to avoid investment risk. Zug-based Genius Yield managed to raise its own seed funding via a community-based initial stake pool offering (ISPO) on Cardano.

In an ISPO, a new project that needs funding first opens up a public stake pool. Cardano users then delegate their ADA token rewards of 4%–5% annual percentage yield (APY) in exchange for receiving the native tokens of the project.

Unlike traditional fundraising mechanisms, the principal is not at risk, as it is delegation only, with no exchange of funds. The maximum loss, all else equal, is the 4%–5% opportunity cost of the yield that would have been earned via ADA staking should the project go bust.

Risk is a relative concept though: How do you weigh up the chances of a centralized service collapsing against the risk of a smart contract being exploited? SEBA Bank’s Alexander points out that DeFi is more likely than CeFi to be victims of devastating hacks, but it offers other tangible benefits, too.“It really depends on what users value most out of factors such as openness, transparency, permissionless, security, risk, compliance, etc.,” he says. Genius Yield’s Bertin believes the core reason DeFi will outcompete CeFi is self-custody. Crypto can be held in personal wallets where only the user has the private spending key.

“You have sole control over your funds — period. Your funds can’t be seized or spent by any other party,” he says.

It’s clear that the “DeFi” sold to retail users across 2021 and 2022 to attract deposits was nothing more than irresponsible and unsecured trading of user funds via centralised management.

In some cases, even via single private keys (not even multi-sig!)

🧵

— THORChain (@THORChain) July 8, 2022

In contrast, CeFi institutions like banks or centralized exchanges can freeze, seize or restrict access to your funds at any time. Self-custody also protects users from the failures of the centralized entity. When Celsius and Voyager became insolvent this year, customers who had millions of dollars worth of crypto on these platforms had their funds frozen.

“These customers may lose all their funds not due to their own decisions or mistakes, but to the decisions of those who ran these CeFi firms,” he says. On the other hand, there’s no reversing transactions or recovering stolen funds in DeFi, and if you lose your seed phrase, you’ve lost your funds forever. So, some will choose to trust centralized institutions, while others will choose to trust themselves.

So, while there’s a place for both CeFi and DeFi, Genius Yield co-founder and association president Laurent Bellandi is much more bullish on DeFi’s future.

“Despite the many unknowns, factors suggest that this sphere could become a major force in the financial world,” he says.

“As the market recovers, laws are created, trust is restored, and more people become aware of the potential of DeFi products and services, the scene will only draw more capital.”

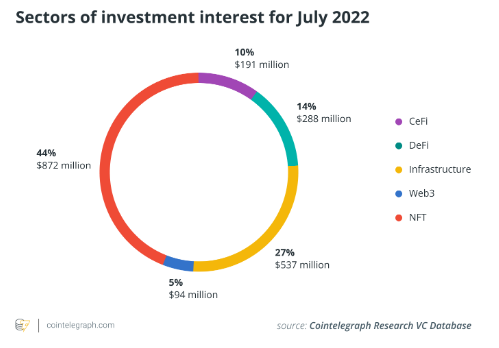

The stats seem to bear that out. Capital investment in the crypto sector reached $31.3 billion year-to-date in July 2022, surpassing the entirety of 2021. And at the time of publication, the total value locked in DeFi protocols per DefiLlama stands at $61.55 billion. To be fair, that’s half the amount of TVL as August 2021, but it’s several orders of magnitude greater than in August 2020. Despite setbacks, it looks like the trajectory is very much headed upward for DeFi.

Be the first to comment