Bitcoin is trading at $17,765 during the Asian session on December 14, as investors appear to price in weaker-than-expected US CPI figures. Similarly, Ethereum has risen above the $1,300 mark, as the weakening of the US dollar has increased demand for cryptocurrencies.

Major cryptocurrencies were trading in the green early on December 14, as the global crypto market value increased by 2.52% to $870.79 billion on the previous day. Over the last 24 hours, the overall crypto market volume has increased by 52.60 percent to $53.51 billion.

DeFi’s total volume is currently $2.94 billion, accounting for 5.49 percent of the entire 24-hour volume in the crypto market. The overall volume of all stablecoins is now $53.26 billion, accounting for 99.53 percent of the total 24-hour volume of the crypto market.

Let’s take a look at the top 24-hour altcoin gainers and losers.

Today’s US FOMC and FED Expectations

At the end of its two-day policy meeting on Wednesday, the Federal Reserve is expected to raise interest rates by a half a point, signaling a less aggressive approach from the central bank as evidence emerges that inflation may be slowing. That’s still hardly anything, especially when compared to the quarter-point rises announced at the last four Fed meetings.

Still, it’s a hefty rise that will hurt the economies of millions of American businesses and households by making it more expensive to take out loans for things like homes, vehicles, and other necessities than they otherwise would be.

The expected move by the Fed would push the rate at which banks charge each other for overnight borrowing to between 4.25 and 4.5 percent, the highest level seen since 2007.

When the Federal Reserve releases its economic outlook in the Summary of Economic Projections on Wednesday, investors will be paying close attention. And they will be tuning in to Powell’s news briefings to get a sense of what’s to come, even if they might be in for a big letdown.

Impact on Cryptocurrency Market

With the 0.50% rate hike, we may see a dip in the cryptocurrency market, but it is likely to be temporary, and prices will return to where they were before. Because most of the 0.50% rate hike has already been priced in, the market is unlikely to show significant price movements unless the Fed surprises with a 0.75% or 0.25% rate hike.

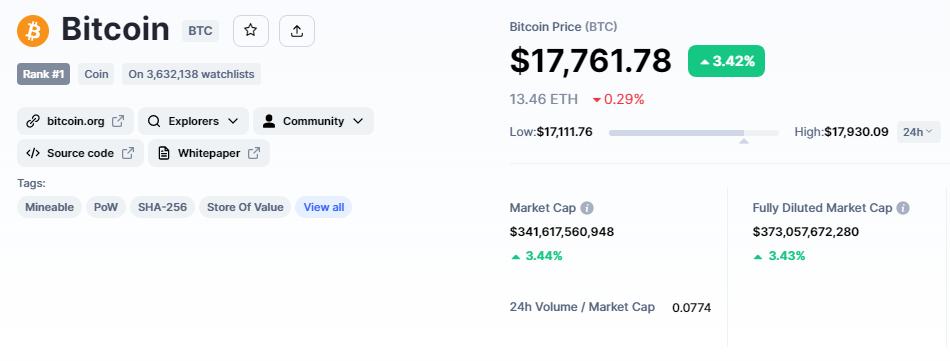

Bitcoin Price

Bitcoin’s current price is $17,755, and the 24-hour trading volume is $26 billion. The BTC/USD pair has gained nearly 3.5% in the last 24 hours, while CoinMarketCap currently ranks first with a live market cap of $341 billion.

Bitcoin is currently on the rise, having broken through a key resistance level at $17,350. This suggests that the purchasing trend may continue.

Leading technical indicators, such as the relative strength index (RSI) and the moving average convergence divergence (MACD), are currently in positive territory, implying that the price of Bitcoin may continue to rise.

Bitcoin’s next major resistance level is at $18,125, and a break above this level could lead to further gains and a price of $18,600.

On the downside, the level of $17,350 may serve as support for the price of BTC. This level has previously served as a barrier, and it is likely to maintain BTC’s bullish trend.

A bearish crossover below this level, on the other hand, could lead to a drop in the price of BTC to the $16,850 level.

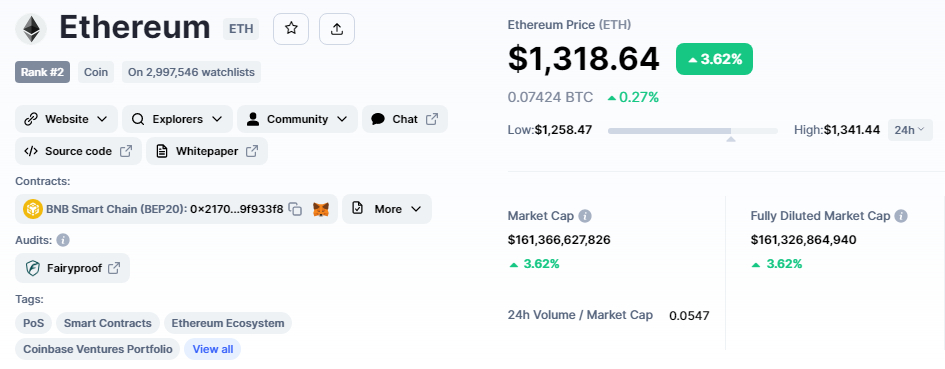

Ethereum Price

Ethereum’s current price is $1,318, with an $8 billion 24-hour trading volume. In the last 24 hours, Ethereum has gained nearly 4%, and CoinMarketCap currently ranks second, with a live market cap of $161 billion.

On the 4-hour chart, Ethereum has violated an ascending triangle pattern that was extending resistance at the $1,305 level. This level is now acting as a support. The bullish bias is indicated by the 50-day moving average, RSI, and MACD indicators.

On the upside, Ethereum’s immediate resistance remains at $1,345, and a bullish crossover above this psychological trading level could expose ETH to $1,385 territory.

Alternatively, a break below $1,310 may expose ETH to the $1,260 level.

Dash 2 Trade (D2T) – Final Stage of Presale

Dash 2 Trade is an Ethereum-based trading intelligence platform that helps investors make better trading decisions by providing real-time analytics and social trading data. It will go live in early 2023, and its D2T token will be used to pay monthly platform subscription costs.

The Dash 2 Trade presale has already raised more than $9.7 million in its fourth and final stage. It has also announced listings on Uniswap, BitMart, and LBANK Exchange for early next year, implying that early investors will soon be able to lock in some profits.

Visit Dash 2 Trade Now

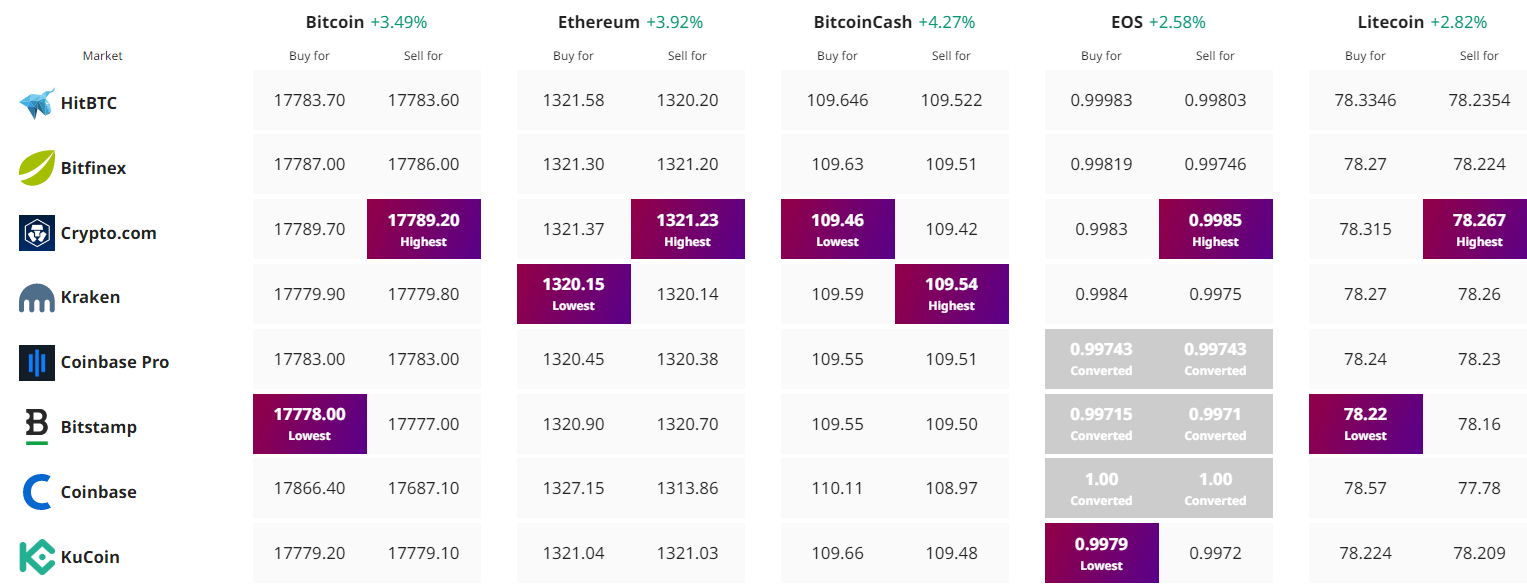

Find The Best Price to Buy/Sell Cryptocurrency

Be the first to comment