Daniel Batten, a climate tech investor, Bitcoin environmental impact analyst, and CEO of CH4 Capital, has released another groundbreaking research that positions BTC as the world’s premier Environmental, Social, and Governance (ESG) asset. His analysis provides a detailed and data-driven perspective on Bitcoin’s potential and challenges the prevailing narratives.

Bitcoin Market Cap To Hit $3.3 Trillion

Batten’s research highlights a critical opportunity for Bitcoin in the realm of ESG investment. With around $23 trillion locked in ESG funds seeking sustainable investments, BTC’s current market cap of $724 billion presents a stark contrast to other institutional-grade assets, usually measured in trillions.

“Commentators including Willy Woo have argued that Bitcoin needs to stay above $1 trillion before the institutions that hold the wealth of nation states and/or retirement funds feel comfortable investing in it en masse,” Batten speculates.

His analysis, supported by experts like Willy Woo, proposes that a mere 1% allocation from ESG funds to Bitcoin could increase its market cap to approximately $1.68 trillion. An aspirational goal of 2.5% allocation could potentially skyrocket the market cap to around $3.3 trillion.

“Thanks to [Willy] Woo’s analysis, we can forecast that impact within a range,” explained Batten, adding that according to the model, the price increase is between 1.30 and 4.80 dollars per dollar invested.

“[This] puts it on the roadmap for institutional investors. As institutional investors invest into Bitcoin, this further increases Bitcoin’s market cap, and now we have a positive feedback loop: catalyzed by initial engagement between the Bitcoin and the ESG community,” Batten further argues.

The Best ESG Asset

Batten has always been at the forefront, preaching the ESG superiority of Bitcoin. His research critically examines the prevailing ESG arguments against Bitcoin. These include concerns about its energy usage, emissions, and reliance on fossil fuels.

In his latest piece, he points out that these arguments are largely based on a single study from the Cambridge Centre for Alternative Finance. Batten argues that this study’s data is outdated, particularly in the rapidly evolving context of BTC mining.

To counter the outdated perceptions, Batten developed the BEEST model, which incorporates off-grid mining data. This model reveals that a substantial portion of BTC mining (approximately 28% by hashrate) is conducted by 52 off-grid mining companies, predominantly using sustainable energy sources (nearly 80%).

Notably, this information was not included in the Cambridge research and directly challenges the conventional narrative by demonstrating a significant shift towards sustainable energy usage in mining.

Overall, the Bitcoin network uses over 52% sustainable energy. “This makes it the world’s leading industry user of sustainable power,” remarks Batten who added that BTC’s emissions have not increased in the last 4 years with the rising adoption.

A pivotal aspect of Batten’s research is his emphasis on mining’s role in methane mitigation. This focus is not only innovative but also addresses a major environmental issue. Batten argues that BTC mining can profitably mitigate methane emissions, especially from landfills. This approach not only reduces a potent greenhouse gas but also provides a viable and profitable use for otherwise wasted energy.

Batten’s research quantifies the environmental impact of Bitcoin mining in methane mitigation. He notes that miners are already mitigating 6% of the entire network’s emissions annually, a figure he believes can be significantly increased with targeted initiatives. For instance, mining on just four mid-sized landfills venting methane could triple emission mitigation efforts.

The research also extends beyond environmental concerns, delving into the social and governance aspects of Bitcoin. He emphasizes that BTC’s potential as an ESG asset is not limited to its environmental benefits but also includes its ability to improve governance and foster social benefits, especially in underdeveloped regions affected by methane emissions.

In conclusion, Batten’s insights suggest that BTC does not only align with ESG criteria but could play a pivotal role in addressing some of the world’s most pressing environmental challenges, making it an attractive option for ESG-focused investors. The Bitcoin price could benefit heavily from this emerging narrative.

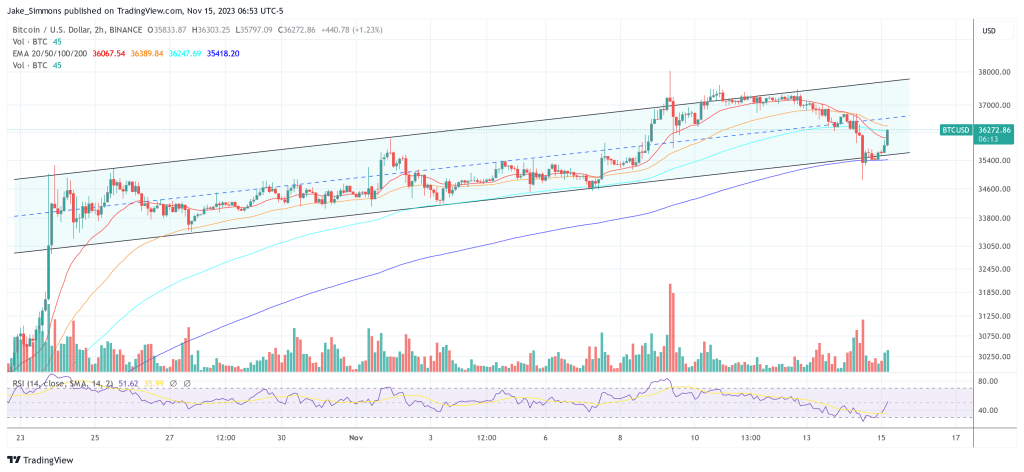

At press time, BTC traded at $36,272.

Featured image from YouTube @Lugano Plan B, chart from TradingView.com

Be the first to comment