Bitcoin has experienced a whirlwind of volatility over the weekend, reaching the psychological $100K mark and a new all-time high of $103,600. Despite this milestone, the price continues to struggle to maintain levels above $100K, raising questions about the strength of the current rally.

Metrics from CryptoQuant reveal a significant trend among Long-Term Holders (LTH), who are actively taking profits. These holders have an average purchase price of $23.4K, realizing an impressive 326% gain on their investments. While this behavior reflects confidence in locking in profits at higher levels, it could also signal caution, as such sell-offs have historically slowed momentum during bull runs.

This wave of selling could spark concerns among investors hoping for uninterrupted upward momentum. Some fear it may create resistance that hinders Bitcoin’s ability to sustain its ascent beyond the $100K threshold. At the same time, it highlights the calculated strategies of experienced market participants, balancing optimism with prudence.

The coming days will be pivotal as BTC navigates this crucial juncture. Whether BTC reclaims its footing above $100K or succumbs to pressure will shape the broader market’s sentiment and determine the next phase of its historic bull cycle.

Demand Remains Strong

Bitcoin has been displaying impressive demand, with the price only experiencing a 10% retrace in the past month after breaking the significant $100,000 level. This shows that the momentum driving Bitcoin’s rise remains strong, and it’s only a matter of time before the cryptocurrency continues its push to new highs.

Analyst Axel Adler recently shared metrics that support the ongoing bullish trend. One key observation is that Long-Term Holders (LTH) are actively selling coins, realizing substantial profits. These holders have an average purchase price of $23.4K, and with current prices, they are sitting on an impressive 326% gain. As these LTHs sell off their holdings, new investors are stepping in to absorb the supply, keeping demand high.

This dynamic highlights a crucial point: the continued supply from LTHs is likely to increase as their profits grow. With such a significant percentage of profit being realized, more LTHs will continue to sell, which will fuel further market activity. However, this does not signal a bearish trend, as new investors are quickly absorbing the supply, and the overall demand for BTC is unwavering.

Given these factors, the BTC bull run appears to be just getting started. As LTHs continue to sell and more fresh capital enters the market, the stage is set for Bitcoin to push beyond current levels and potentially set new all-time highs. The ongoing demand, coupled with profit-taking behavior from long-term holders, suggests that the market is entering a period of sustained growth.

Bitcoin Struggles Above $100k

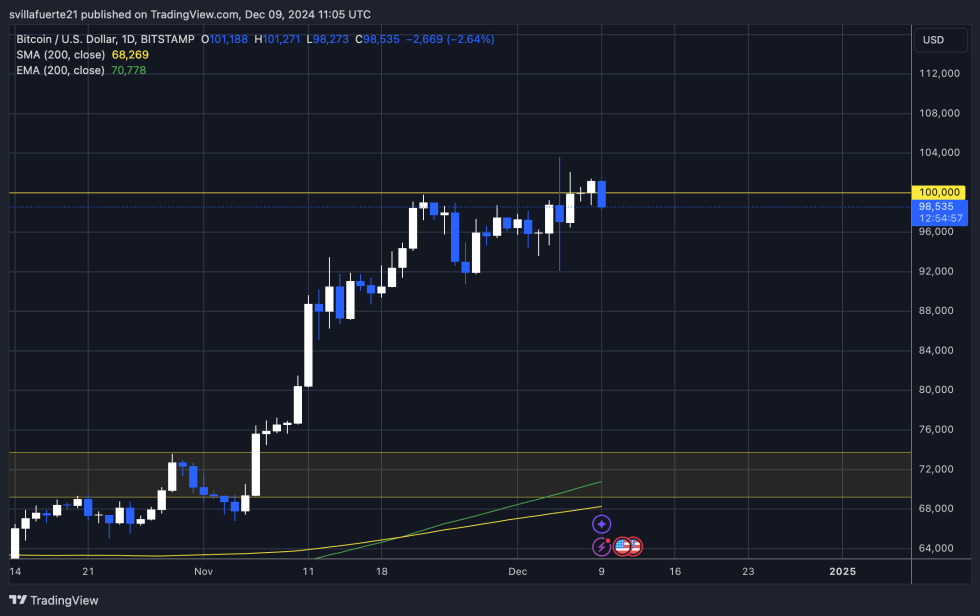

Bitcoin is currently trading at $98,500 after failing to break and hold above the $100,000 level three times in less than a week. The repeated struggle to maintain price above this key psychological level has raised concerns as BTC experiences increased volatility.

This could be attributed to whales taking profits after significant gains, given the massive rise from the $60,000 range. However, if demand continues to push forward and more buyers enter the market, Bitcoin could finally establish a solid foothold above $100,000.

The market’s reaction to this crucial level is a clear indication of ongoing market dynamics. If buying pressure remains strong, BTC could see a sustained push above $100K, with a potential consolidation phase above this mark. This would signal that Bitcoin’s upward trend is far from over and that the market remains in a bullish cycle.

Traders and investors will be closely monitoring these price movements in the coming days to gauge whether the $100,000 resistance turns into a support level, paving the way for further gains. Ultimately, continued demand from both retail and institutional investors could fuel Bitcoin’s next leg up, reaffirming its long-term bullish momentum.

Featured image from Dall-E, chart from TradingView

Be the first to comment