Bitcoin led the market gains with a swift recovery above the $20,000 mark. Ethereum and XRP, along with other top altcoins, charted hefty gains.

The global crypto market cap finally breached the $1 trillion mark, which aided market bullishness. Bitcoin (BTC), Ether (ETH), and XRP noted high daily gains as bears finally took a back seat.

After the crypto market started to turn green on Tuesday, over $1.2 billion in short liquidations took place in around 24 hours. The crypto market finally broke free from the tight price range it had oscillated in since September.

Despite the notable gains and bullish sentiment across the market, BTC price had stabilized at the $20,600 mark. On the other hand, ETH and XRP price also faced rejection at their upper resistance levels.

Bitcoin On-Chain Analysis: Bulls Might Have to Wait

At the time of writing, Bitcoin price traded at $20,598.99, presenting a 1.17% pullback on the daily time frame. Data from IntoTheBlock’s In/Out of Money Around Price Indicator suggested that $20,323 acted as the next significant support for BTC price, where 843,000 addresses held over 725,000 BTC.

With BTC short-term price action weakening, a fall below $20,323 could induce sell-side pressure.

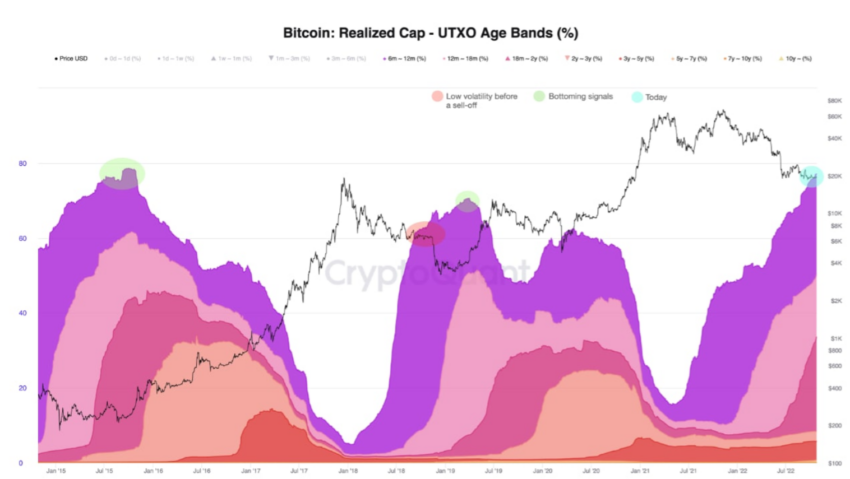

Many in the market thought that a Bitcoin bottom was in place; however, data from CryptoQuant highlighted that on-chain validation still lacked for the crypto market bottom.

During the 2015 and 2018-2019 cycles, Bitcoin price move in a similar rangebound momentum, with price volatility dropping to its lowest levels. When volatility drops to historically low levels, it indicates that the downward trend is coming to an end. However, during the 2018 cycle, low price volatility swiftly followed a 50% Bitcoin price drop from $6500 to $3200 in just one month.

At the time of writing, MVRV and UTXO Realized Cap 6 months and older Age Bands presented that Bitcoin price was in the value range. A considerable length of time needs to pass before the 1-3 months UTXO Age Band Realized Price is overtaken for a prolonged growth trend; for now, that level is at the $21,264 mark.

As seen in the chart above UTXO age bands are still away from bottom signals. In addition to that, Puell Multiple for Bitcoin price still wasn’t in the “strong buying area” since it moved to 0.62.

While BTC exchange reserves have decreased over the last few days leading to lower selling pressure, the Net Unrealized Profit and Loss (NUPL) is still in the Capitulation phase. The NUPL was below 0, presenting buy signals; however, it’s not as appealing as it was during the 2020 bottom when it stood at -0.18.

Ethereum On-Chain Analysis: Price at Crossroads

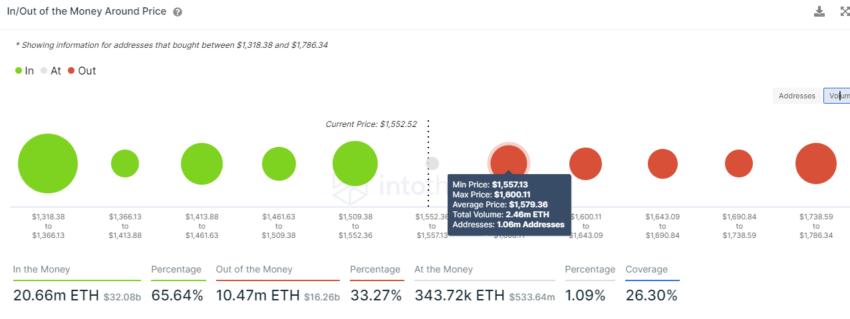

Ethereum price traded at $1,552 at press time, noting 1.41% daily losses. ETH price had reversed most of the September-mid losses that brought its value below the $1200 mark. However, there were still significant barriers that lay ahead of ETH bulls.

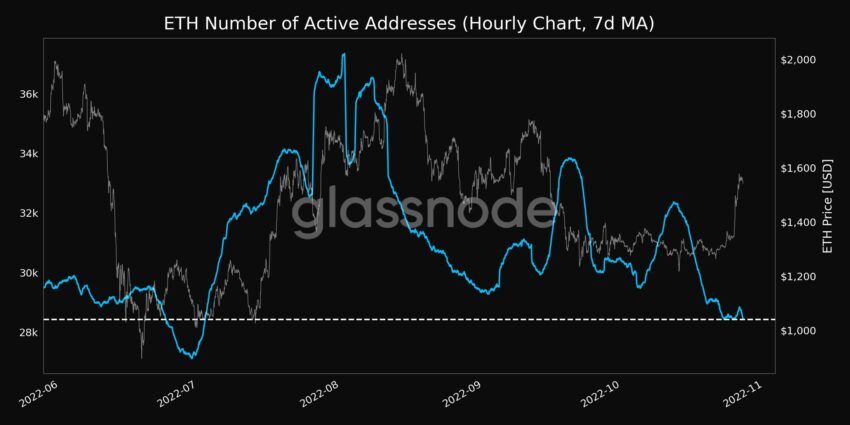

Data from Glassnode highlighted that ETH Number of Active Addresses (7d MA) just reached a 3-month low of 28,431.935 despite the recent gains.

Furthermore, ETH 365-day and 30-day MVRV noted healthy upswings recovering from the June and July lows. However, a slight downtick in MVRV presented that gains could be limited, and ETH bulls could continue the struggle going forward.

Going forward, if the ETH price falls below the $1531 mark, the same could lead to increased sell-side pressure for the coin. Data from IntoTheBlock highlighted a significant resistance for ETH at the $1579 mark, where over 1 million addresses hold 2.46 million ETH.

XRP On-Chain Analysis: Where is the Catalyst?

As for XRP price, the 6th ranked crypto by market cap, charted merely 3% gains over the last three days. At press time, XRP price traded at the $0.4698 mark, noting 0.36% and 1.79% gains on the daily and weekly charts.

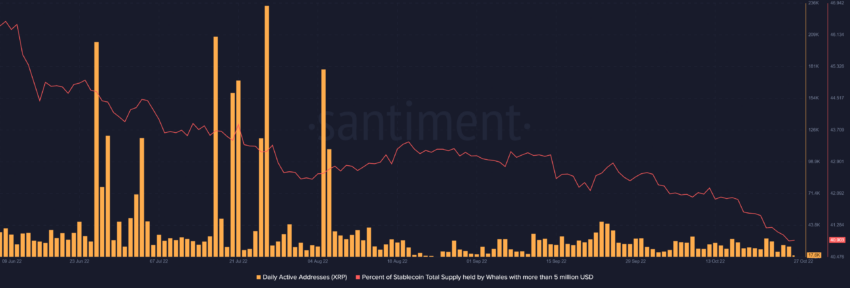

XRP price has been in a long-drawn downtrend, since Oct 10, despite Ripple victories in the ongoing regulatory battle.

Whales accumulated close to 300 million XRP over the last few months, but this didn’t affect XRP price much. Meanwhile, development activity and stablecoin total supply held by whales with more than $5 million saw a continued downtrend.

Furthermore, active addresses saw no upswing even though prices made some strides in the upward direction.

XRP price could present some gains moving towards the $0.488 mark if retail volumes can aid price momentum. However, if the XRP price breaks below the $0.38 mark, the same could spell trouble for the coin.

Disclaimer: All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Be the first to comment