Worldwide adoption of Bitcoin started with countries resisting the control of their centralized fiat currencies. Nigeria, El Salvador, Ghana, and more have witnessed a growing trend for “How to buy Bitcoin” Google searches for over five years now despite some hiccups.

Bitcoin, the largest cryptocurrency, has had an exciting journey since its inception. Starting from being valued at less than $1, it reached an all-time high of $69,000 in 2021. However, in the bear market that followed, it slipped back to trading for $17,000. Over the years, Bitcoin has weathered several of these crypto winters. It has even been proclaimed “dead” more than 400 times.

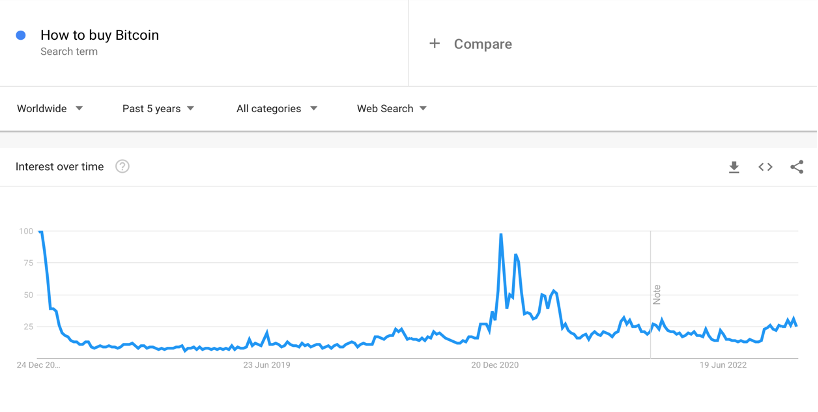

Google search trends still strongly correlate with BTC price movements. The graph below shows the past five years for BTC in terms of price vs. Google searches.

The popularity and hype of Bitcoin throughout its different bull cycles have created stirs in regions across the globe. This can be seen with the “how to buy Bitcoin” search query, which not so surprisingly skyrocketed in 2017 and at the end of 2020.

The metric here peaked (a value of 100 is the peak popularity for the term) in the 2017-18 period. However, it has declined since. This is due to various factors, including exchange collapses and stricter regulations.

Here’s a breakdown of the countries that stood out on this list, compiled by BeInCrypto in descending order.

Nigeria

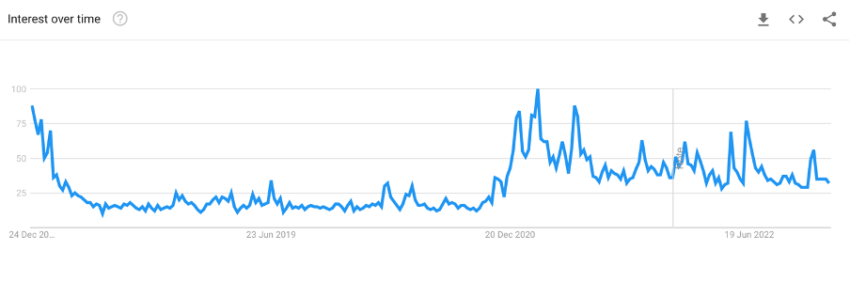

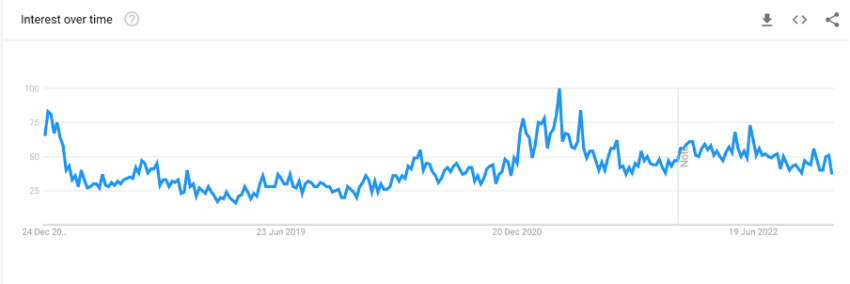

In Nigeria, the ‘How to Buy Bitcoin’ search query has remained fairly high since 2017. Currently, the metric stands at 45. Interest peaked around mid-2020, as is evident in the plot below:

Why is that the case? Why does Nigeria rank #1 here when compared to other countries?

The adoption of crypto in Nigeria is developing at an exponential pace. The country currently has greater than 50% month-to-month active adult crypto investors. Numerous citizens favor storing their money in virtual currencies over fiat because of the constant devaluation of the Naira.

It is estimated that one-third of Nigerians have already invested in Bitcoin.

Nigeria’s crypto adoption, similar to most other developing international locations, is fuelled by inadequate financial services. To satisfy this inadequacy, Nigerians started using crypto as an opportunity to save and protect those savings.

In 2021, the Nigerian government introduced the eNaira, a central bank digital currency (CBDC). Nigerians have been reluctant to adopt the eNaira because of its centralized control. This shows a great deal of distrust in the powers that control the money supply.

BeInCrypto reached out to sources in Nigeria to comment on the rise of crypto adoption. A Twitter account named ‘Nigeria Bitcoin Community’ gave us their opinion:

“BTC adoption is high in Nigeria because governments don’t help in any way at all, and the young are looking for any way possible to make money for themselves, and crypto seems to be the best alternative to many.”

It further added:

“Even though crypto adoption is growing rapidly in Nigeria, we have some barriers here Government restricted all banks in Nigeria from being a merchant to any crypto exchange, which means no one in Nigeria can buy bitcoin or any cryptocurrency through his bank card or directly from bank We use the P2P system here.”

El Salvador

In the second half of 2021, El Salvador became the first country in the world to adopt bitcoin as a legal tender (though this is often disputed as Japan passed a similar act in 2017). The start of the road was bumpy. The country had to deal with various technical problems and a slump in Bitcoin prices at the same time.

One year in, most major franchise chains in the capital accept Bitcoin via smartphone wallets. In addition, the Salvadorian government introduced a network of 200 Chivo Bitcoin ATMs to familiarize consumers with BTC.

Government officials in El Salvador claim that the introduction of Bitcoin will increase the affordability of services, expand payment options, and increase financial innovation.

Facing some problems

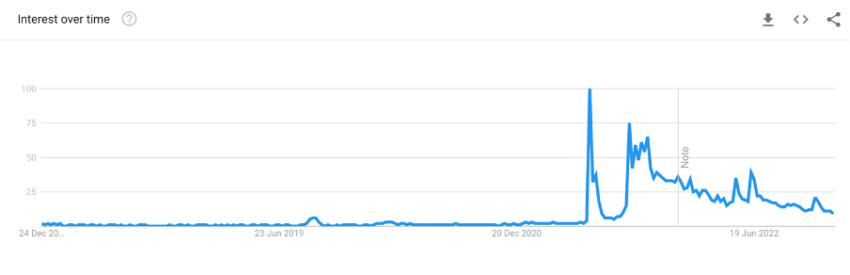

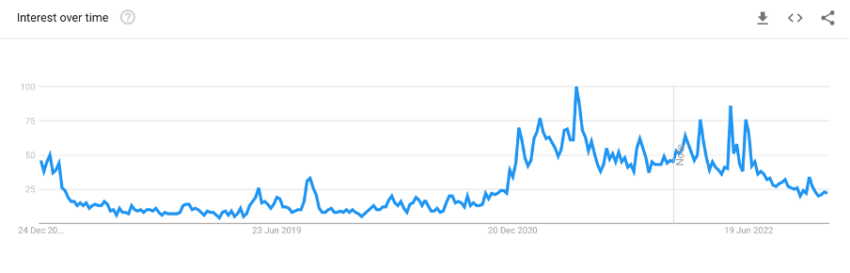

Success could encourage other countries to adopt cryptocurrencies. However, as seen from the graph, interest in Bitcoin has been sinking, especially for many skeptical El Salvadoran vendors.

BeInCrypto had reached out to a spokesperson of La Union, a municipality organization of La Unión Department of El Salvador. When asked about any positives regarding the adoption of Bitcoin as legal tender in the region, we received a single-sentence reply that read:

“Nothing positive has happened.”

The President, Nayib Bukele, continues to take significant steps to bolster Bitcoin adoption.

Beyond El Salvador, Bitcoin, cryptocurrency, and stablecoins have very high adoption rates in countries like Colombia and Argentina. Latin America is certainly no stranger to periods of high inflation or monetary repression, leading to the general public’s affinity for cryptocurrencies.

Bitcoin is believed to stand the test of inflation since its supply is finite. There will only be 21 million Bitcoins ever created. Thus, when the demand for Bitcoin increases, its value also increases. The limited nature of the currency prevents inflation and can potentially help to reduce global poverty.

Slovenia

Let’s shift our focus now to central Europe. Slovenia, in particular, is a forerunner in crypto adoption.

The country is quickly turning into central Europe’s cryptocurrency and blockchain capital. With such fast adoption rates, Slovenia’s government is experimenting with new legislation that will allow it to properly evaluate crypto holdings and transactions of individuals and businesses for taxation purposes.

In Q1 22, the Financial Administration of the Republic of Slovenia (FURS) proposed a tax rate of 10% to be levied for crypto-to-fiat swaps. The same tax rates will also apply to any purchases made with cryptocurrencies. How much taxation might affect the nation’s crypto future is yet to be seen. For now, the country’s capital, Ljubljana, has become a paradise for crypto enthusiasts.

Locals can forget their fiat currency and traditional payment methods like credit cards at home and live a typical day with their crypto holdings. The city has 137 businesses and 584 locations accepting cryptocurrencies as payment methods. Slovenia has more physical sites that accept crypto payment methods than even the entirety of the United States.

BeInCrypto reached out to numerous representatives operating in the country, however, we haven’t yet received any responses.

Ghana

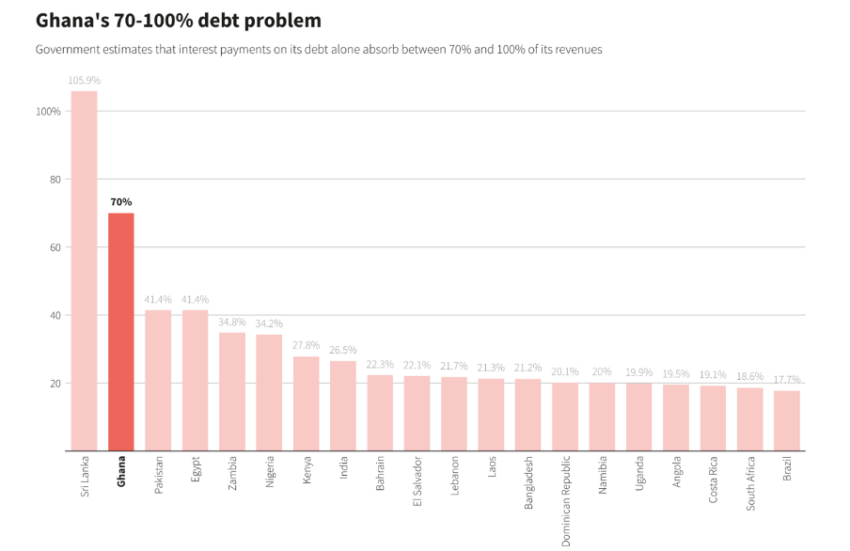

Like in other African countries, Ghana has been a victim of rising inflation and debt. Revenue earned by the government used to offset pending debts has risen to 70%:

To offset the suffering, locals in Ghana have lent support to Bitcoin despite warnings from the country’s regulators.

Google trends indicate that Ghana is among the top 5 international locations to run queries on Bitcoin.

In its State of Crypto: Africa report, Arcane Research showed an organic and growing interest in cryptocurrency. Bitcoin ownership in Ghana is said to be over 900,000, which is more than 3% of the country’s total population.

Meanwhile, Ghana also ranks exceptionally high in Bitcoin mining interest.

Paxful, a cryptocurrency exchange, even opened a Bitcoin Technology Center in Ghana, as shared in a Dec. 21 tweet:

Georgia

Georgia has always been a trailblazer in many facets of Bitcoin adoption. Like most other top crypto-adopting countries, Georgia had significant help from the government. Five years back, it became the first country to use blockchain to register property transactions.

Over the period leading up to 2022, the government took several initiatives to bring cryptocurrency into everyday financial transactions organically. In the past year, Georgia has hosted the first international web3 conference led by DeGameFi and announced efforts to legalize cryptocurrency by adopting EU standards. It even collaborated with several crypto exchanges, such as Binance, to encourage more institutional adoption of blockchain.

While the government is making steady efforts, the general public continues to adopt crypto mostly through P2P transactions and a network of Bitcoin ATMs.

Speaking to BeInCrypto, a local news agency asserted that the country was already in the works to adopt Bitcoin across the region.

India

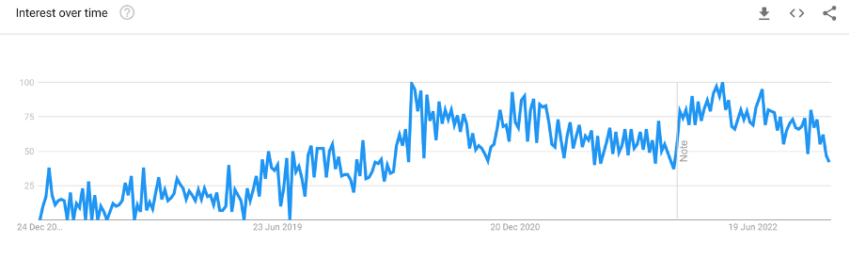

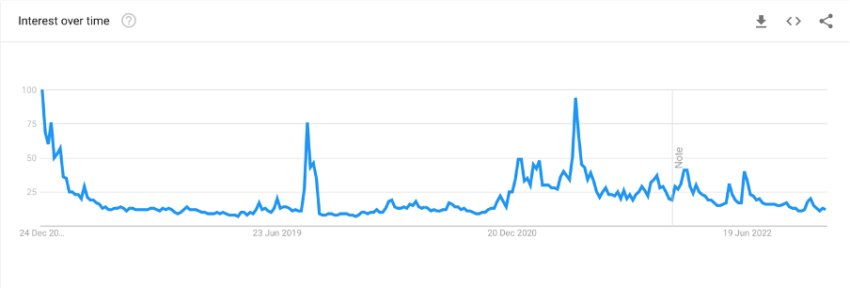

India is easily one of the biggest markets for Bitcoin, especially given the country’s massive population. Interest in Bitcoin can be seen in the plot below:

Three main factors fuel Bitcoin adoption in India. First, there is a growing cultural movement driven by crypto meet-ups in major cities with varied audiences ranging from prominent global CEOs to teenagers. This surge of interest from such a diverse audience encourages more people to join the movement and participate in the industry in varying capacities.

The large influx of capital in web3 and blockchain projects is the second-factor fueling adoption. In 2015 and 2016, a $1 million grant for founders building crypto companies was considered an enormous feat. Today, founders can easily raise $2-3 million in just pre-seed rounds.

The third factor propelling BTC, and blockchain adoption at a government level, is a heavy-duty focus on building state and central government projects like land registration, blood banks, public distribution systems (PDS), and remote voting chains implemented on the blockchain. Although these projects do not have a tokenized approach, it’s still a major step toward broader blockchain adoption.

However, many regulators and higher-ups are still cautious when it comes to Bitcoin and crypto adoption due to the heavy influx of scams and fraud in the space.

Closing thoughts

Bitcoin can be a crucial tool in aiding locals struggling with their respective economies and centralized authorities.

Since its advent in 2009, Bitcoin has grown immensely in price. However, it still sees little use as a means of payment. One reason for this is Bitcoin’s capacity and constraints on processing transactions. These constraints have hindered its scalability compared to centralized public giants structures such as Visa or MasterCard.

Although with the rise in the second layer Lightning Network, Bitcoin users can more easily make instant transactions for a low fee.

One of the companies incorporating the Lightning Network is Strike. Per a report shared with BeInCrypto, Strike even received an additional $80M in funding to bolster Bitcoin payments for merchants.

BeInCrypto also reached out to Strike CEO Jack Mallers for comment but hasn’t received a response yet.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Be the first to comment