Key Takeaways

Hayes suggests Solana could be a strong play amid election volatility, potentially outperforming Bitcoin in bullish trends.

The Federal Reserve’s monetary policy is expected to have a more significant impact on digital assets than the US election outcomes.

Share this article

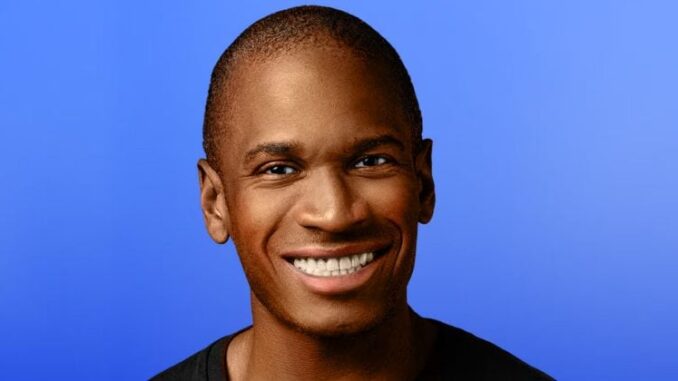

Arthur Hayes, co-founder of BitMEX and CIO at Maelstrom, favors Solana ahead of the US elections, describing it as a “high beta Bitcoin” during an appearance on the Unchained podcast.

With the elections just days away, Hayes explained that Solana is a good bet because it is highly liquid and likely to jump if Bitcoin performs well.

Additionally, Hayes asserted that, in the long run, it doesn’t matter who wins the US election, as the overarching influence on digital assets will be the FED’s decision on whether to cut rates on November 7.

“The bigger picture remains focused on the Federal Reserve’s monetary policy rather than the immediate outcomes of the elections,” he explained.

Hayes also remarked that he favors Solana over ETH, describing Ethereum as ‘too slow’ right now and in need of a narrative shift to change people’s mindset about its poor performance in recent months.

He noted that Solana currently has the ‘mind share,’ moves quickly, and will likely outperform Bitcoin when the market pumps, whereas Ethereum is ‘equal beta’ to Bitcoin, or perhaps even a bit lower.

During the podcast, Hayes pointed out that Solana’s impressive rise from around seven dollars to over one hundred and eighty dollars, particularly post-FTX collapse, underscores its ability to gain and hold value rapidly.

Hayes also touched upon regulatory aspects, cautioning that significant improvements in crypto regulations are unlikely, irrespective of political changes.

His advice to investors and traders is to focus more on market fundamentals rather than political developments, which often have transient impacts on market dynamics.

The session wrapped up with Hayes emphasizing the strategic importance of selecting high-beta assets like Solana during times of predicted monetary easing.

Share this article

Be the first to comment