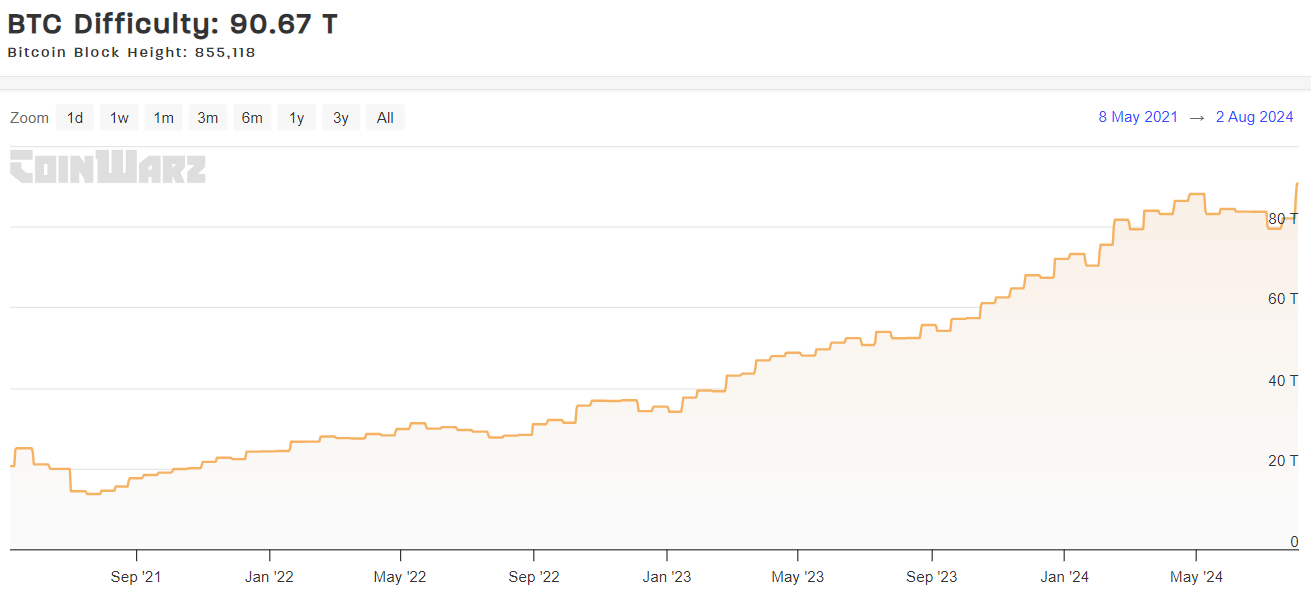

Bitcoin’s network difficulty hits a record high of 90.67 trillion as of August 2, 2024.

Bitcoin’s hash rate reached a record 677 EH/s on July 27th, boosting network security.

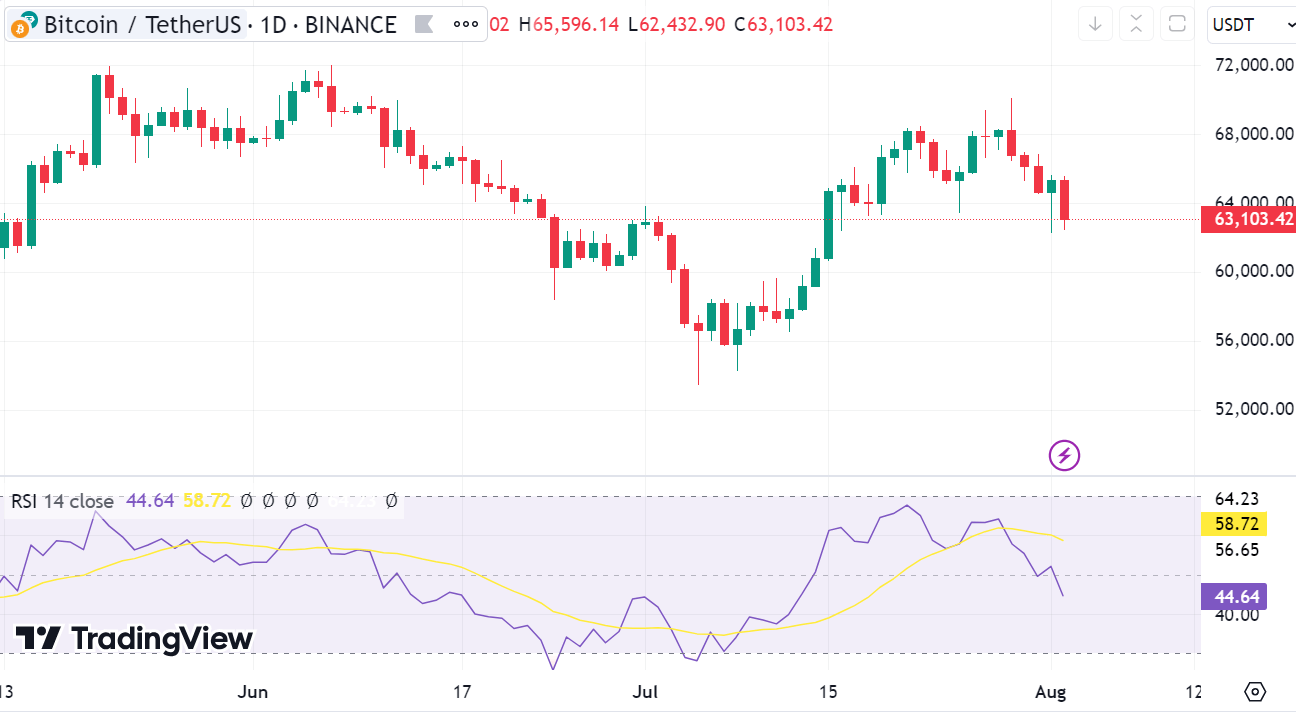

Bitcoin’s RSI at 44 suggests potentially oversold conditions; the price may test $58,000

Bitcoin has set a new record for network difficulty, reaching 90.67 trillion on August 2, 2024 according to data on CoinWarz.

This milestone represents a significant rebound following three months of declining difficulty, signalling renewed confidence among miners in the cryptocurrency’s network.

The increased difficulty implies that mining new Bitcoin blocks now requires more computational power, potentially driving up operational costs and influencing Bitcoin’s future supply and pricing dynamics.

Bitcoin’s hashrate also hit an all-time high

On July 27th, Bitcoin’s hashrate surged to a record 677 EH/s, reflecting a robust and secure network infrastructure. This peak suggests intensified competition among miners and strengthens the network’s resilience against potential security threats.

A high hashrate not only indicates increased mining activity but also has the potential to positively impact Bitcoin’s price by boosting investor confidence.

BTC price under increased bear pressure

Currently, Bitcoin is trading at $63,103.42, showing a 0.17% increase over the past 24 hours. The cryptocurrency has been fluctuating between $62,248 and $65,593, suggesting a mild recovery trajectory despite recent volatility.

If this trend continues, Bitcoin may avoid the $62,000 resistance level, potentially paving the way for new highs.

However, the Relative Strength Index (RSI) for Bitcoin is at 44.64, indicating that the cryptocurrency is approaching oversold conditions.

A declining RSI points to diminishing bullish momentum, and if bearish forces intensify, Bitcoin might test its next support level at $58,000. Further declines could follow if market pressure persists.

Overall, Bitcoin’s rising network difficulty and hashrate highlight a strengthened and competitive mining environment. These factors are essential for evaluating the network’s health and security as Bitcoin navigates through ongoing price volatility.

Be the first to comment