A few weeks ago, Ethereum Name Service (ENS) price inched closer to $35. But since the beginning of July, the value has struggled to attain such heights.

Currently trading at $27.38, on-chain analysis shows that things are happening behind the scenes that could soon send ENS in that direction.

Record Whale Accumulation Sparks Hope for Price Rally

Despite wobbling around a tight-trading range, IntoTheBlock reveals that whales have increased their ENS holdings. Specifically, the Large Holders Netflow shows that the accumulation began around July 21.

Large Holders Netflow tracks the activity of market participants who hold a substantial part of a cryptocurrency’s total circulating supply.

An increase in the metric implies strong buying activity from whales. However, a decrease implies that there is a larger outflow than inflow, and this could negatively impact the price. For ENS, the Large Holders’ Netflow increased by a mind-boggling 882.87% within the last seven days, as shown below.

Read More: Ethereum Name Service (ENS): Everything You Need To Know

This is evident from the incredible purchase of 165,850 tokens on July 22. If sustained, this could drive positive momentum for ENS price.

According to BeInCrypto’s findings, the recently launched spot Ethereum ETFs could be one reason for the hike in accumulation.

Before the SEC gave the green light to begin trading, there was speculation that the approval could benefit the prices of Ethereum-related tokens.

Since ENS is one of those, it is likely that whales are strategically positioning themselves to anticipate a price increase due to the development. However, hikes on the Ethereum Name Service network did not end with whale accumulation.

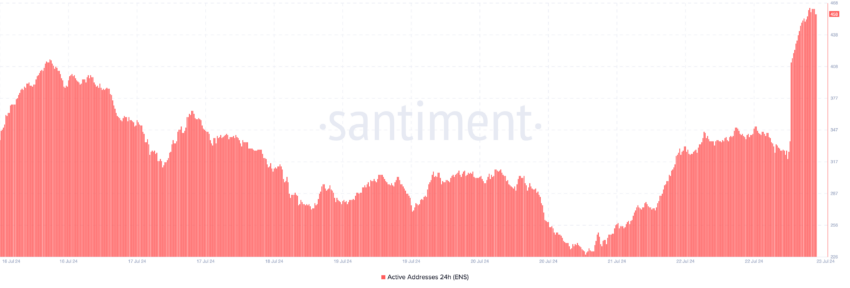

An assessment of the network shows that activity on it has reached its highest since July 11. According to Santiment, the 24-hour active addresses, which were previously down, suddenly spiked to 458.

Ethereum Name Service active addresses are distinct users involved in successfully sending or receiving ENS.

In most cases, an increase in bullish price while a decrease signals otherwise. Therefore, if user engagement on the network continues to jump, ENS price could trade higher in the coming days.

ENS Price Prediction: $30 Remains a Strong Resistance Level

The ENS/USD daily chart shows that the token has been consolidating between $24.87 and $28.84 for almost two weeks. Furthermore, this sideways trading could continue for some time.

This assertion is supported by the Commodity Channel Index (CCI). In simple terms, the CCI measures the current price condition relative to the average price level over a given period.

High readings of the CCI show that prices are far above average. However, a low rating indicates that the price is below the average level in the short term.

In the ENS case, the CCI reading increased, but it does not seem high enough to support an extremely strong upswing. If this continues, ENS could keep trading between a swing high of $28.35 and a low of $26.50.

Read More: Ethereum Name Service (ENS) Price Prediction 2024/2025/2030

However, if whale accumulation continues in large numbers, the token may exit consolidation and probably move toward $30.97.

In addition, if the spot Ethereum ETFs see a massive inflow of funds in the first week, the uptrend could be validated.

Meanwhile, CyptoBull_360, a pseudonymous trader on X, opines that the token could trade higher in the short to mid-term.

“ENS is getting ready for a massive breakout from multiple resistance zones by forming bullish engulfing candle from PoC value zone n 4Hr TF, consolidation above the zone might trigger strong rally towards $45-$50 zones.” The trader stated.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment