The recent introduction of Bitcoin exchange-traded funds (ETFs) in the United States, considered a watershed moment for the cryptocurrency’s mainstream adoption, has sparked a nuanced response characterized by a blend of optimism and skepticism. Despite an initial surge in investment, recent data signals a decline in overall Bitcoin wallet activity, introducing an element of uncertainty regarding the lasting impact of these ETFs.

Diminishing Enthusiasm

Concerns over diminishing enthusiasm are substantiated by data from Santiment, a data analytics firm, revealing a consistent reduction in the number of crypto wallets holding any amount of the cryptocurrency since the ETF approval roughly four weeks ago. This downward trend suggests a potential retreat from direct Bitcoin ownership, with fears of uncertainty and doubt (FUD) potentially influencing investor sentiment.

📉 #Bitcoin‘s wallets (with greater than 0 coins) are still declining as #crypto nears 4 weeks since the #SEC‘s 11 Spot #ETF approvals. This can be attributed to crowd #FUD, and less interest in direct $BTC ownership due to other investment alternatives. https://t.co/tjnjELxGw1 pic.twitter.com/xRymU7C0ro

— Santiment (@santimentfeed) February 7, 2024

A more granular analysis by IntoTheBlock further illuminates this trend, highlighting a significant decrease in daily active and new addresses. This indicates a diminishing level of user engagement and hints at a possible shift in interest towards alternative investments. Intriguingly, the total number of BTC addresses has remained relatively stable, showcasing minor fluctuations over the past month.

Conflicting Narratives

Interpretations of this data vary within the industry. Notable figures like Anthony Scaramucci downplay pessimism, underscoring the substantial $5 billion ETF debut and challenging critics to redefine their criteria for success. However, financial institutions such as LPL Financial advocate for a cautious approach, reflecting a divided sentiment within the market.

BTC market cap currently at $842.298 billion. Chart: TradingView.com

Bitcoin Miners On The Move

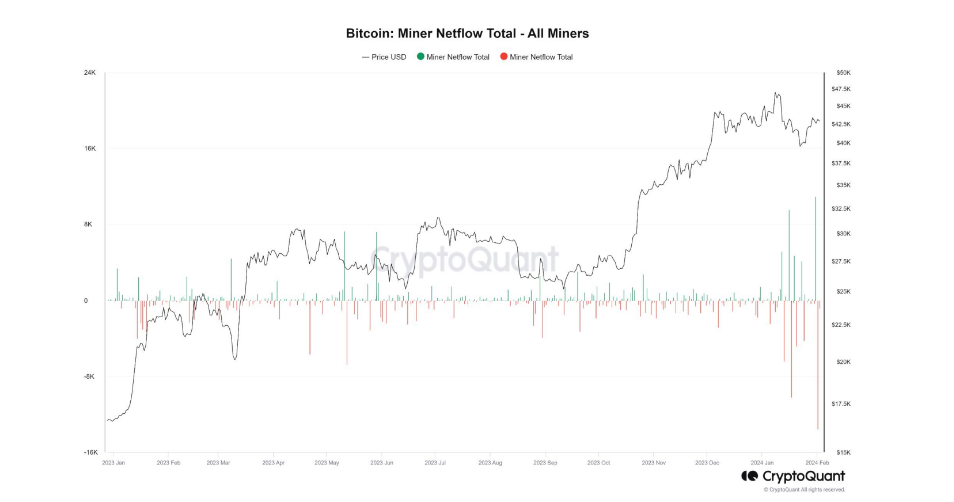

Beyond investor behavior, the launch of Bitcoin ETFs has significantly impacted crypto miners, who validate network transactions and receive Bitcoin rewards. Bitfinex Alpha reports a noteworthy development, with over $1 billion worth of Bitcoin flowing from miner wallets to exchanges in the first 48 hours of trading – a six-year high in miner outflow. This phenomenon suggests potential selling pressure or strategic rebalancing activities by mining companies.

On-chain data showing miner wallet Bitcoin inflows and outflows after ETF approval. Source: CryptoQuant/Bitfinex Alpha

While the initial investment in Bitcoin ETFs showed promise, the subsequent drop in wallet activity and the surge in miner selling activities raise questions about the long-term implications of these financial products.

The true narrative remains obscured by various factors, including the limited timeframe analyzed, the specific profiles of investors withdrawing from wallets, and the influence of broader economic conditions on cryptocurrency markets.

Featured image from Adobe Stock, chart from TradingView

Be the first to comment