Bitcoin miners have started moving their assets which could lead to more selling pressure if they are liquidated.

On May 19, on-chain analytics platform CryptoQuant reported on recent Bitcoin miner movements.

It noted, “Bitcoin miner reserves are decreasing, indicating a selling pressure from the miners’ side.”

The chart shows a sharp decline in the reserves following the Bitcoin 2023 price high in mid-April. Another smaller dip occurred later in the month and both were followed by price declines.

The latest dip in miner reserves occurred this week and coincided with an inflow to Binance, according to CryptoQuant.

Bitcoin Miners Preparing to Sell?

The analyst identified two transactions of 1,750 BTC from miner wallets to an exchange. “There is a high probability that 1,750 BTC ultimately went to Binance,” they added.

The coin movement comes from the Poolin Bitcoin miner address, they added. At current prices, it is valued at around $47 million. This is just one Bitcoin miner, but they usually sell around similar times, so there could be downward pressure on markets.

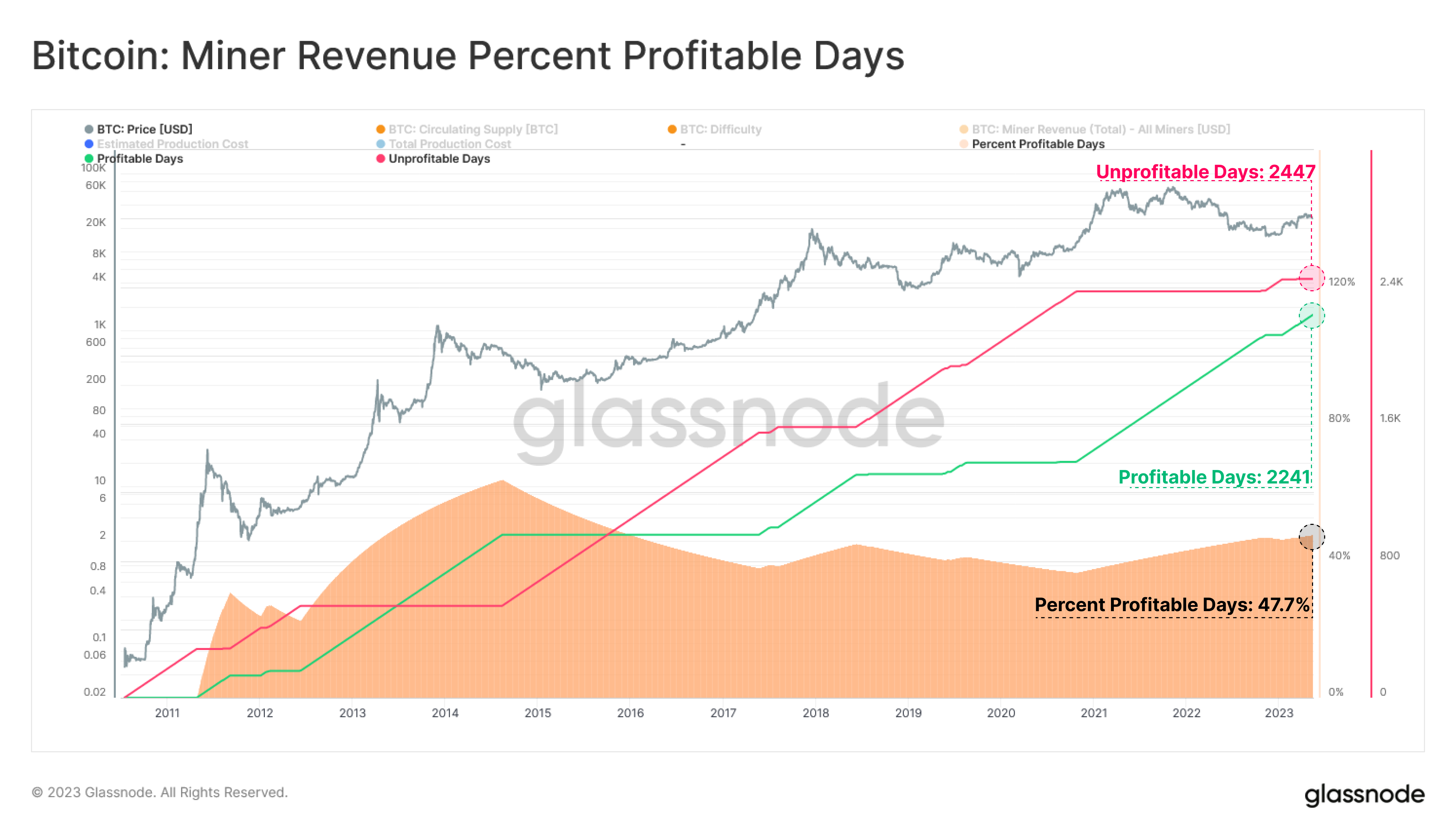

On May 18, on-chain analysis firm Glassnode reported that Bitcoin mining profitability had also fallen.

“Upon assessing the number of trading days where Miner Revenue exceeded the daily Production Cost, we find that this was the case on 47.7% of trading days, and thus 52.3% of trading days have been unprofitable for the average miner.”

According to Hashrate Index, mining profitability or hash price has fallen to $0.076 per terahash per second per day. It spiked to $0.127 on May 9 due to the surge in transactions driven by the memecoin minting craze.

Furthermore, the hash price has declined 38% since the same time last year, making Bitcoin mining less profitable.

Additionally, hash rates are close to peak levels at 373 EH/s (exahashes per second), according to Bitinfocharts. Combining this with an almost peak level of difficulty, and high energy prices, shows that Bitcoin miners are having a rough ride at the moment.

BTC Bears Lurking

More selling pressure could result from the large number of Bitcoin options that are due for imminent expiry.

BTC prices have fallen 2.3% from their intra-week high of $27,500 on Monday. They have fallen to $26,863 at the time of writing and are looking to weaken during the weekend.

There is short-term support at $26,300 and more at the $25,000 level should the selling pressure intensify. However, the longer-term outlook appears to be bullish.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Be the first to comment