In an era of wavering faith in economic leadership, the American public’s trust in Jerome Powell, the Federal Reserve’s Chair, is declining. Is this merely a symptom of a volatile economy or a more profound shift in public sentiment toward Bitcoin?

As central bank strategies come under scrutiny, the potential for alternative financial systems, such as Bitcoin, is drawing increased attention. Could this digital currency reshape the nation’s financial landscape, providing stability amidst uncertainty?

The Declining Trust in Jerome Powell: An Unprecedented Shift

In a striking twist, the American public’s confidence in Jerome Powell is rapidly eroding. Gallup’s recent survey reveals a record low 36% of Americans believe in Powell’s economic acumen.

This figure represents the nadir of Powell’s six-year reign. It is the lowest confidence rating Gallup has recorded for any Federal Reserve Chair since its data tracking began with Alan Greenspan in 2001.

Interestingly, 28% of Americans profess almost no confidence in the Republican Federal Reserve Chair, originally nominated by former President Donald Trump.

The significance of this development cannot be understated. The Federal Reserve, often envisioned as an unshakeable bastion of wisdom, relies heavily on public trust for its operational effectiveness. The institution’s success hinges on its perceived dependability and ability to shape policy effectively, free from political interference.

The power of belief in the Federal Reserve’s commitments is substantial. Should Jerome Powell pledge to curtail the soaring inflation rates, for instance, the American public’s faith in his promise can provoke behavioral changes, effectively setting a self-fulfilling prophecy in motion.

Recent turbulence in the banking sector only amplifies the need for such unwavering trust. The Federal Reserve needs to persuade the public of the stability of regional banks. The future well-being of the economy could hang in the balance.

However, the public’s perceptions and reality often diverge, and the Federal Reserve is not immune to the unpredictable swings of economic sentiment. The growing unease among Americans about the economy is increasingly reflected in their views of key government officials responsible for economic policy.

The Federal Reserve’s Battle with Inflation: A Slow and Steady Approach

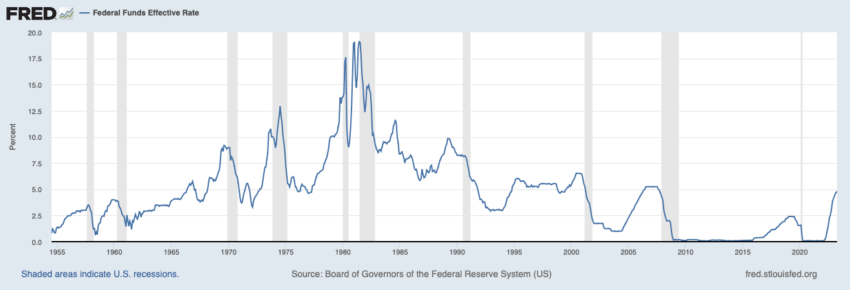

The Federal Reserve has attempted to stem inflation by implementing a series of interest rate hikes in just over a year. This aggressive action has taken a toll on the economy. Despite some easing of inflation rates, they remain significantly above the Federal Reserve’s 2% target level.

The American public’s awareness of inflation, which is generally unwelcome, is a clear indicator of the Federal Reserve’s challenges. If the public loses faith in Powell’s messaging, it might herald more significant concerns.

Given his role, the public’s skepticism of Powell may be par for the course. But interestingly, they seem to believe that he will fulfill his promises.

For instance, the Federal Reserve has hinted at a probable pause in rate hikes at the upcoming meeting. Market predictions align with this forecast, showing a 90% chance of it transpiring.

However, to sustain public confidence, the Federal Reserve must convincingly demonstrate its ability to achieve its 2% inflation target before it eases its policy. This suggests that interest rates may remain high, potentially increasing further if inflation does not fall into line.

The credibility of the Federal Reserve will face another significant test soon. Essentially how the American public perceives its regulation of the banking industry. This brings one to a crucial question: could Bitcoin, the decentralized crypto, be the answer?

Bitcoin: The Beacon of Hope in a Trust-Deficient Economy?

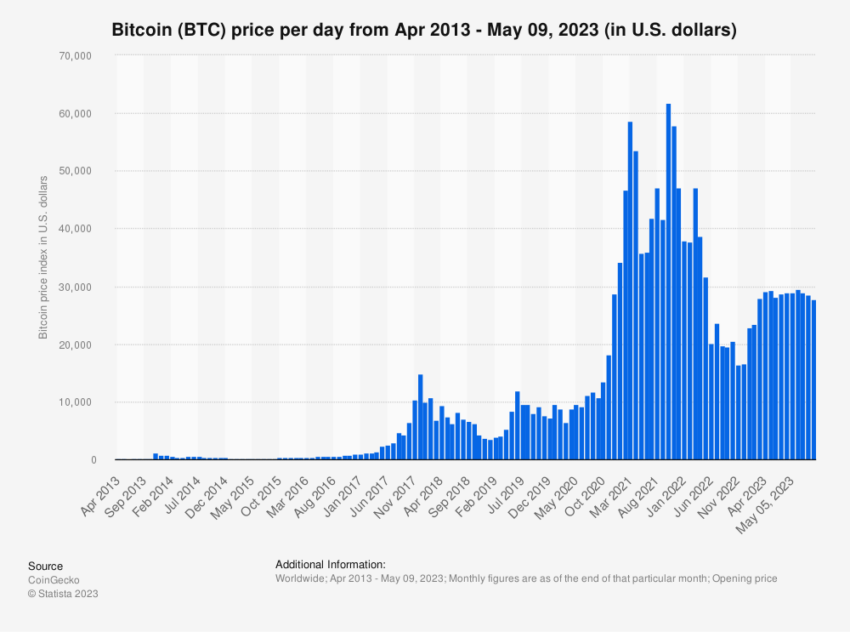

Bitcoin, with its peer-to-peer transaction system, offers a potential alternative. As the public’s trust in centralized institutions dwindles, the appeal of a decentralized, transparent, and tamper-proof system increases.

The leading digital currency provides an alternative financial landscape free from the influence of individual personalities and policy decisions. As such, it might just be the beacon of hope that America needs, reshaping the nation’s financial landscape and restoring trust in a time of uncertainty.

Bitcoin could offer an alternative solution that does not rely on the trustworthiness of a single individual or institution but operates on a transparent, immutable ledger. With the power to validate transactions and store value, Bitcoin could become a pivotal part of a more decentralized, resilient financial system.

In these challenging times, the Federal Reserve’s mission to moderate inflation seems slow and steady. As annual inflation cooled last month to its lowest level since April 2021, the question remains whether the Federal Reserve’s approach will be effective in the long run.

Even though the Consumer Price Index (CPI) has gradually decelerated, the inflation rate remains uncomfortably high. This has led to speculation on whether the Federal Reserve might pause its interest rate hikes.

While the answer lies in the uncertain future, the potential for Bitcoin as a safe haven is becoming increasingly plausible. Bitcoin’s decentralized nature makes it immune to the whims of policy changes, making it a more stable store of value.

As trust in traditional institutions like the Federal Reserve continues to erode, the allure of innovative, decentralized alternatives such as Bitcoin becomes increasingly irresistible.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

Be the first to comment