The stock and crypto market appear to have not yet won over investors, despite a bullish pivot seen in January 2023 after last year’s devastating sell-off that wiped out trillions of dollars in value.

This is according to a note from Bank of America, which highlighted the fact that cash held in money market funds has reached a record high of $4.8 trillion as interest rates remain at multi-year highs. Most money market funds are yielding about 4%.

Waiting On the Sidelines

Investors are cautious when it comes to stocks, as evidenced by year-to-date fund flows, which have been strong for fixed income and emerging market equities but weak for US stocks. Investment grade and high-yield debt have seen the strongest inflows since September 2021, averaging $7.7 billion over the past month. Meanwhile, emerging market debt and equity has seen its strongest inflows since March 2021, with $7.1 billion over the past month.

It appears that investors are also pulling money out of US technology and healthcare stocks. Bank of America has called this trend “capitulation.” The outflow trend from these two sectors over the past month is the worst since January of 2019.

The weekly AAII Investor Sentiment Survey also indicates that investors are bearish towards stocks. Indeed, bearish respondents outweighed bullish respondents by 36.7% to 28.4%.

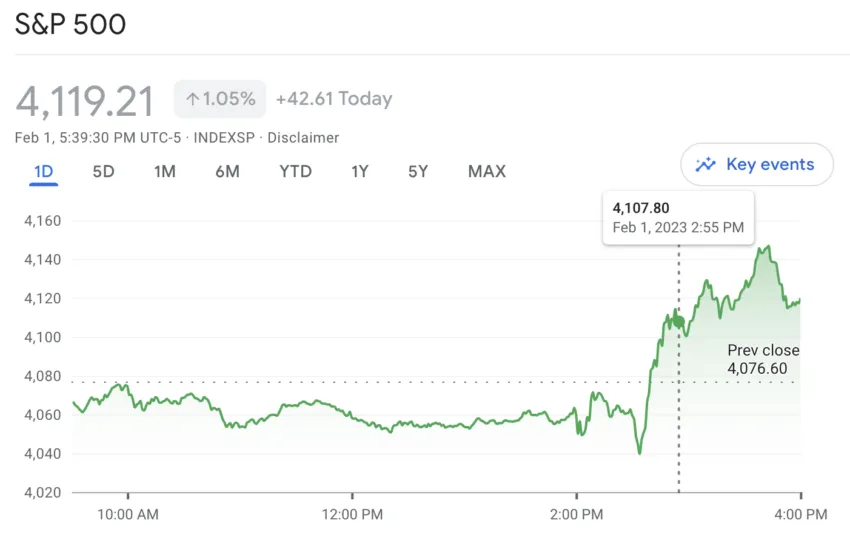

Still, Bank of America’s Michael Hartnett sees a good reason for this bearishness. While he admits that the “pain trade” for the stock market remains higher, he recommends investors pull back from the S&P 500 once it reaches the $4,100 to $4,200 range.

Interestingly, the S&P 500 hit a high of $4,150 on Wednesday, Feb. 1, following a statement from Federal Reserve Chair Jerome Powell, hinting that the disinflationary trend in the economy has commenced.

Hartnett anticipates that a hard landing will occur in 2023 and another tightening of financial conditions this spring may be required to tip the US economy, which is currently growing at over 7% in nominal terms, into a recession.

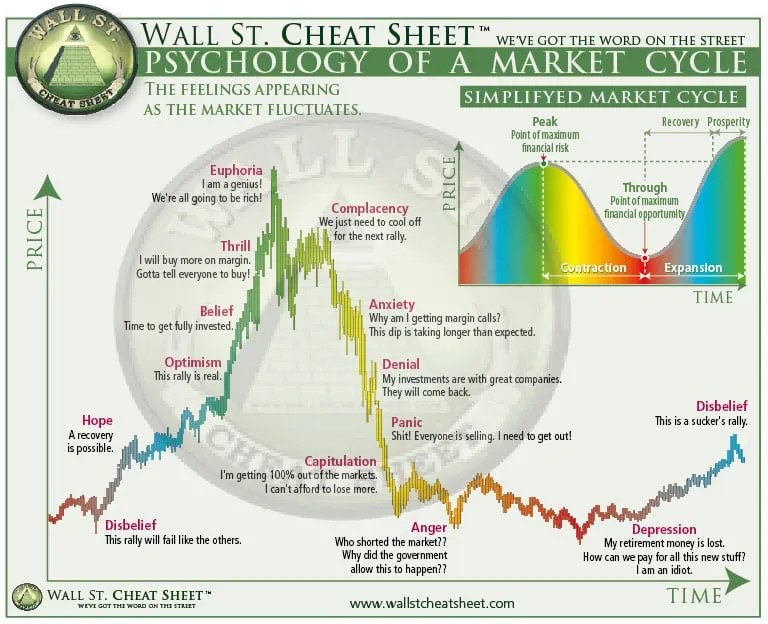

Crypto Investors In Disbelief

The disbelief stage in the psychology of a market cycle refers to a period in which investors are skeptical of the market’s upward trend and remain cautious, even as the market continues to show positive gains. This can happen after a period of significant market volatility or a bear market, during which investors may have suffered significant losses.

During this stage, investors may be wary of jumping back into the market and instead prefer to remain on the sidelines, holding onto their cash or investing in less risky assets. They may also wait for further confirmation of the market’s upward trend before making investment decisions.

This stage is often characterized by a lack of market participants and low trading volumes, as many investors remain skeptical of the market’s direction and are hesitant to invest. This can also result in a lack of momentum in the market, as there may not be enough buying pressure to drive prices higher.

However, as the market continues to show positive gains, investor confidence may gradually return, and more participants may begin to enter the market. This can help to increase market momentum and drive prices higher, as investors become more comfortable with the market’s direction and are more willing to invest.

If part of the cash held in money market funds were to flow into the crypto market, it could have a significant impact. Although Bitcoin has enjoyed an impressive upward price action, posting year-to-date gains of more than 45%, the potential influx of cash could drive up demand, leading to potentially higher prices.

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.

Be the first to comment